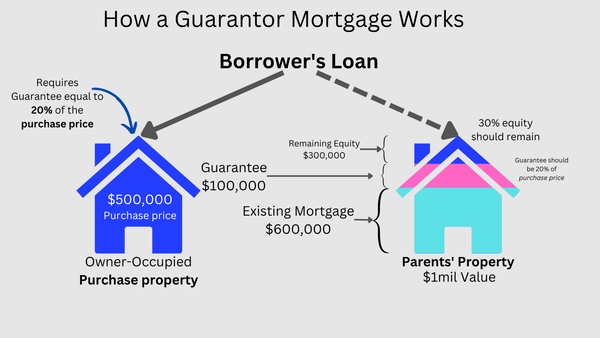

How a Guarantor Mortgage Works

There is a lot of misunderstanding around how a Guarantor Mortgage works, however guarantor loans are being used more than ever. Approximately 33% of all first home buyers in Queensland use a gift or guarantee from their parents when buying. Guarantor loans are becoming increasingly popular, giving parents the ability to help their children into their home by using their equity, not their cash. They do this by putting a guarantee on the first home buyer's loan by allowing the bank to put a mortgage over their own home or investment property. If you are looking to get a guarantor loan, always speak to a Mortgage Broker about your options first.

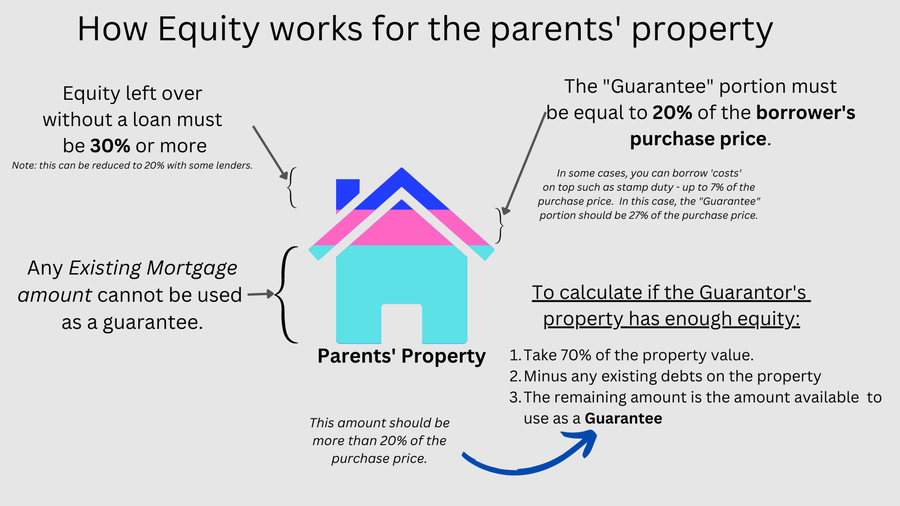

How Equity works in the Guarantor Property

The first thing to check before considering a Guarantor Mortgage is whether the Guarantor's property has sufficient equity available.

Please also note: the Guarantee should generally not be more than 50%-70% of the value of the Guarantor's property (depending on the bank) and the property must be located in Australia.

Most banks want the 'unencumbered' portion of the Guarantor's property to be 30% or higher (after the transaction), however 20% is possible. It is not possible to push the Guarantor's property to 100% LVR - there must be a buffer of 20% - 30%. In some cases, the bank will have restrictions around the Guarantor's property (location and/or type) which may require a lower LVR.

If you're looking to borrow costs also (5% - 7% allowed to cover Government costs etc.), then the Guarantee would be equal to 20% of the borrower's purchase price plus costs.

You can put a deposit in to reduce the Guarantee

It's not uncommon to use a Guarantor to remove LMI and reduce interest rates, even if you already have a deposit < 20%. If, for example, you were putting in a 10% deposit, you may want to add a Guarantor. This will reduce LMI to $0 and attract lower interest rates. In this scenario, the Guarantee over the Guarantor's property would be 10% only.

Who is eligible to be a Guarantor

As a general rule, direct family members are eligible to be a Guarantor. The Guarantor will need to declare their financial situation (income, assets, expenses etc.), but generally won't need to provide much documentation above ID & a Rates Notice.

Most family members with an eligible property can be a Guarantor, but most banks have more specific rules:

| The ideal Guarantor (accepted by most banks): |

|---|

| Using an investment property to Guarantee the loan. |

| Has sufficient assets/income to repay the loan if needed. |

| A Guarantor accepted by specific banks:: |

|---|

| Using their own house to Guarantee the loan. |

| Reliant on Government income for retirement. |

How is a Guarantor Mortgage set up

There are usually two different methods used to setup a Guarantor Mortgage. The method used will depend on the bank you're applying with.

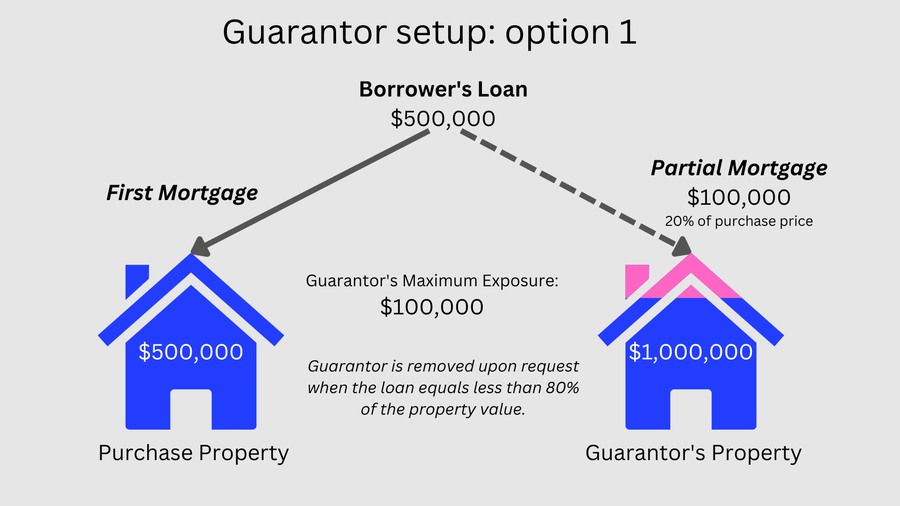

Option 1: Partial Mortgage

Some banks will allow 1 loan for the borrower. They will then put a partial mortgage over the parents property equal to the Guarantee amount (usually 20% of the purchase price).

The advantages of this setup are that it's simple and easy to understand. Lenders that set it up this way will also usually allow a second mortgage over the Guarantor's property - which means the Guarantor can leave their current mortgage with their existing bank.

The disadvantages of this setup are that the Guarantor is liable for the full Guaranteed amount until they are fully released, or the property is refinanced.

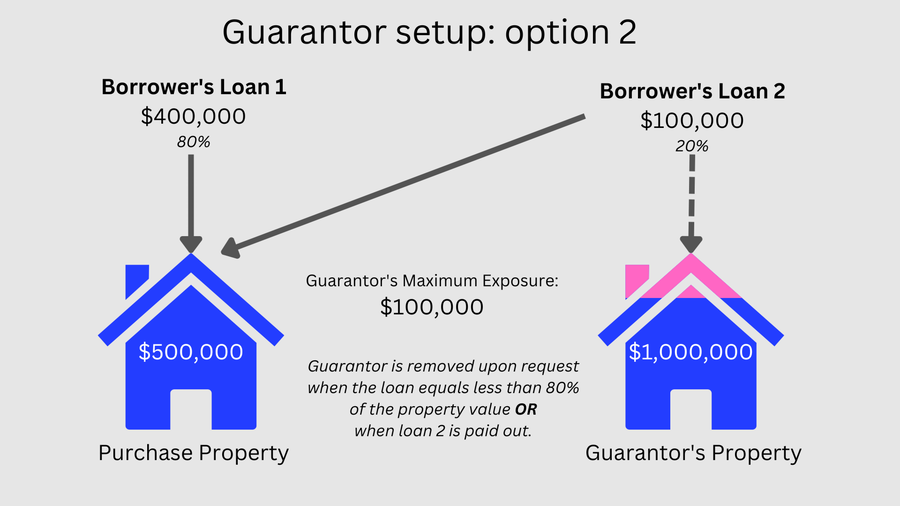

Option 2: Two seperate loans

Other banks will set the loan up as two seperate loans. The first one is an 80% loan secured only by the purchase property. The second loan is then setup and secured by the purchase property plus the Guarantor's property. The second loan is usually for 20% of the purchase price.

The advantages of this setup are that the Guarantor's liability will decrease as the second loan principal decreases. A common setup I use with my clients is to setup the 80% as a fixed loan, and the 20% as a variable loan. Then the borrower can focus on making all extra repayments onto the Guaranteed portion to payout the Guarantor as soon as possible.

The disadvantages of this setup are that the bank usually wants a first mortgage over the Guarantor's property - which means they would need an unencumbered property or to refinance their current mortgage to the same bank.

Is the Guarantor at Risk?

The short answer is yes. If the borrower defaults on their repayments, the bank may contact the borrower to repay the amount of the Guarantee. Under normal circumstances, it would make sense for the Guarantor to assist the borrower with repayments if needed - which would avoid any further action. If the payments aren't made, the bank can ask the Guarantor to repay the amount of the Guarantee. If the Guarantor refuses to repay this amount or come to a payment arrangement, then the bank may look to reposses the Guaranteeing property.

What borrower's are eligible for a Guarantor Mortgage

Generally, the eligibility criteria for being a borrower for a Guarantor mortgage are no different than applying for a regular home loan. Most banks only allow first home buyers, but there are some that will accept non first home buyers.

Note: we don't have bad credit or lowdoc options when using a Guarantor.

| General eligibility for the borrower: |

|---|

| Australian Citizen, Permanent Resident, or allowable Temporary Resident (contact us). |

| Sufficient income for the loan: 1 day permanent, 6 months' casual or 24 months' ABN. |

| Good credit history. |

How to apply for a Guarantor Home Loan

If you'd like your loan setup properly, please contact us to start the process. You can instead apply with the bank of your choice, but that will limit your eligibility options & structural options. If you'd like to get the process started, please contact us via the below form:

Enquiry Form

What should be done before considering a Guarantor Loan?

Talk to a Mortgage Broker, seek independent legal advice, and read all loan contracts very carefully. For more information on the risks involved, please visit ASIC’s page here.

If you have any questions, please call or email me anytime.

References:

https://www.moneysmart.gov.au/borrowing-and-credit/borrowing-basics/loans-involving-family-and-friends https://www.finder.com.au/first-home-buyers-by-state