LMI: What is Lenders Mortgage Insurance in Australia?

Lenders Mortgage Insurance (LMI) in Australia is a type of insurance that allows consumers to purchase a home with less than 20% deposit. All major banks throughout Australia currently require you to pay LMI if you have less than a 20% deposit and have no guarantor. LMI is paid as a once off premium at the start of your loan; it is usually added to the loan (and always should be, see down-page).

LMI is used to protect the Bank in case you default on your loan, allowing them to make a claim against any losses.

If you're applying under a Government Scheme, such as the First Home Guarantee or Family Guarantee, you will not have to pay LMI.

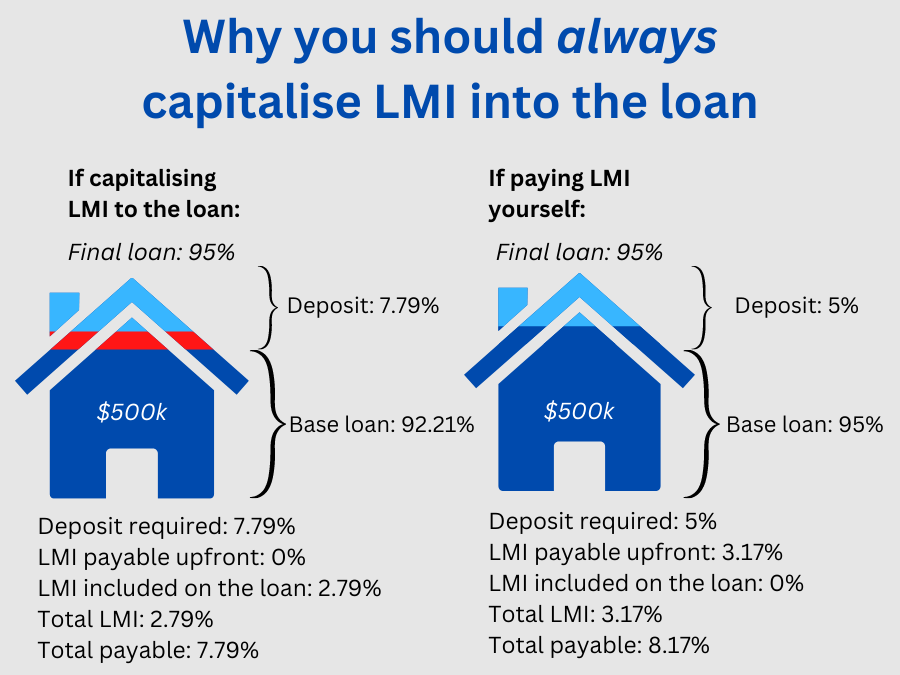

Should you pay LMI or capitalise it the loan?

As a general rule, you should always capitalise your LMI onto your loan. The reason is that the end result is the same, but you end up paying more if you pay the LMI upfront. See below example.

It works this way because LMI is calculted based on the base loan, so putting in a higher deposit and capitalising the LMI is cheaper. Either way, your loan amount ends up the same.

How do I apply for LMI?

The bank will apply for LMI on your behalf. After you've submitted your home loan application, the bank will put together an LMI Application on your behalf and submit it for approval with the LMI Provider unless the lender has a Designated Under Writing Authority (see below).

Do I need LMI?

If you don’t have a 20% deposit, you will always be required to pay LMI with any traditional bank or a 'low deposit premium' (or some synonym of that). Some non-banks don’t require LMI approval; however, will charge a fee of their own which is generally more expensive – this can; however, be a great alternative for people that don’t meet the insurers eligibility criteria.

Does Lenders Mortgage Insurance Protect me?

No. Lender’s Mortgage Insurance is purely for the benefit of the bank and will not protect you in any way should you not be able to make your repayments. For personal protection, please look into Mortgage Protection Insurance, Income Protection and Life Insurance.

How much does LMI cost?

You can find a premium estimator here; however you should always talk to a Mortgage Broker for a more accurate figure. It is also important to remember this needn’t be paid up front, but should be added into your loan (It actually works out cheaper this way).

What is a Designated Underwriting Authority (DUA)?

Some banks have a Designated Underwriting Authority, or DUA, which means they can approve your LMI application on behalf of the Mortgage Insurance Provider. This essentially means that your loan will be auto-approved (sometimes subject to guidelines) for LMI if the lender approves your home loan application.

Will the LMI application slow down my application?

Sometimes. Most major banks have a DUA and can auto-approve your LMI application within their processes - thereby not slowing down the process at all. Any lender without a Designated Underwriting Authority will manually submit your LMI application to the insurer, which can add 24 hours on to your approval time. In most cases, its the smaller lenders that need to submit to LMI providers for manual assessment.

Can you avoid an LMI application?

Sometimes, if you don't meet LMI-specific policies, you can be approved by a lender automatically if they have a DUA (Designated Underwriting Authority). This is most of the major & second tier lenders. Smaller lenders will have your LMI application reviewed manually by the insurer.

Who Provides Lenders Mortgage Insurance in Australia?

There are two major LMI providers in Australia: Helia (formerly Genwroth) and QBE; with a 3rd, international insurer being used by some lenders: Arch.

Some banks also provide their own LMI internally, such as ANZ, Westpac Group & Macquarie.

How will I know if I’m eligible for LMI?

Mortgage Insurers policy documents are hundreds of pages long and unavailable to the general public. You will need to speak to a Mortgage Broker Brisbane to find out if you are eligible for approval.

What if I’m not approved for Mortgage Insurance?

There are still options. There are other financial institutions throughout Australia that will lend to people with a low deposit in a wide variety of circumstances – generally at a higher interest rate. Talk to us for more information.