Stepped vs Levelled – what does it mean and what should I choose?

Insurance policies are paid for monthly / yearly, and the amount the provider charges per year is estimated at the time of application. This yearly amount varies, based on whether you choose a stepped, or levelled premium.

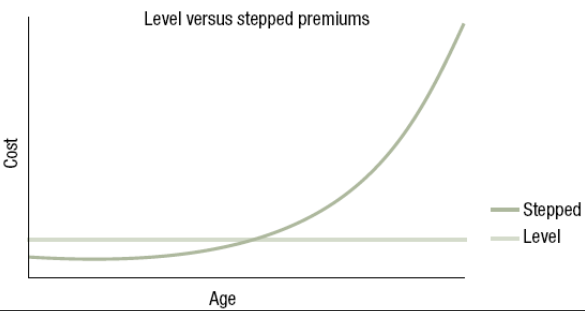

A stepped premium starts out low, and increases over time, with your age. A levelled premium is levelled (i.e., does not increase), however starts out higher. For every application, there is a crossover point, at which the stepped value becomes more expensive than the levelled (see below graph).

As part of your application process, I can provide you with the tables to assess whether a stepped or levelled policy is best for your circumstances, at the time of application. When making a decision the biggest factor is whether the policy is intended as a short-term or long-term policy.