Home Guarantee Scheme

This Government scheme is designed to assist first home buyers & single parents into purchasing a home with a 5% or 2% deposit respectively.

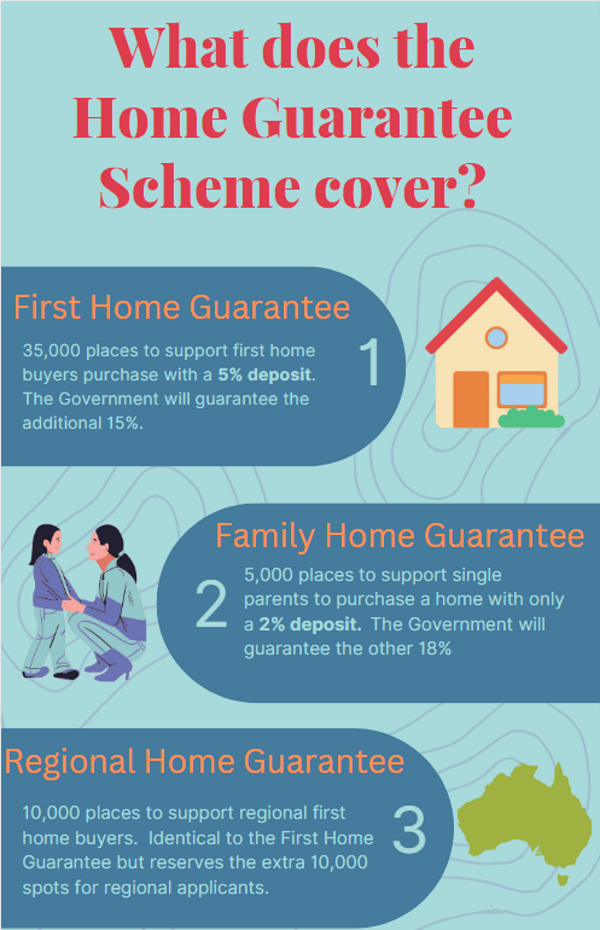

What does the Home Guarantee Scheme cover?

This Scheme currently covers three sub-schemes: The First Home Guarantee, The Family Home Guarantee & The Regionals Home Guarantee.

2024-25 Announcement

The Federal Government has confirmed that 35,000 more spots will be made available in the 2024-25 financial year.

How does the Scheme work?

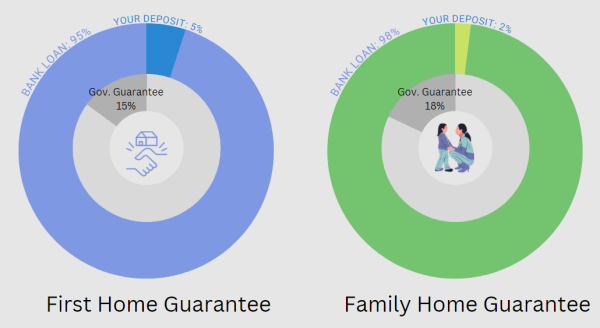

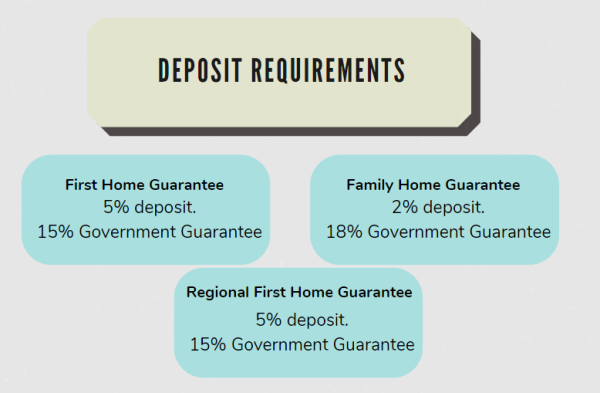

When applying for a home loan with a bank, the Government will add a guarantee to your loan. Your deposit + the guaranteed amount will equal 20% of the purchase price. This means that if you default on your loan, the Government may be liable to pay up to 18% of the property price back to your lender. This adds a huge amount of security for the bank, and results in your loan application being treated as if you had a 20% deposit.

Who is eligible for the schemes?

The eligibility varies slightly depending on which sub-scheme you're applying for.

| Eligibility criteria for the First Home Guarantee & Regional Home Guarantee: |

|---|

| Income of less than $125,000 p.a. for a single applicant, or $200k for joint applicants. |

| For joint applications, the person you apply with may be (but is not limited to): spouse, partner, friend or sibling. |

| Must be purchasing a property to live in. |

| Must not have owned a property in Australia in the last 10 years. |

| Must be over 18 years of age. |

| Must be an Australian / NZ Citizen or Permanent Resident. |

| Must have a 5% genuine deposit. |

| Regional Home Guarantee unique requirement: At least one applicant must have lived in or adjacent to the regional area they're purchasing 12-month period. |

| Eligibility criteria for the Family Home Guarantee: |

|---|

| Income of less than $125,000 p.a. |

| Must be a single parent with at least one dependent child. |

| Must be purchasing a property to live in. |

| Must not own a property currently. |

| Must be over 18 years of age. |

| Must be an Australian / NZ Citizen or Permanent Resident. |

| Must have a 2% genuine deposit. |

We can assist you in applying for a Home Guarantee Scheme spot..

If you'd like us to check your home loan eligibility and provide you with your options, please submit an enquiry through the contact form.

Enquiry Form

Advantages of applying.

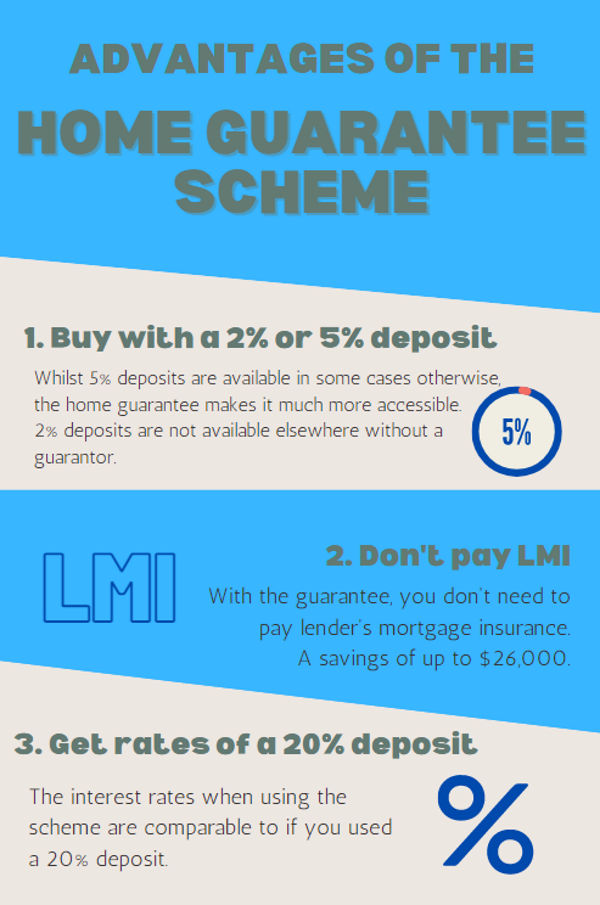

The main advantage is that it will let you buy a home sooner, and with a lower deposit. You will also be assessed for your home loan much less strictly because of the Guarantee - which makes approval for weaker applications easier. There are also a number of additional cost savings, including Lender's Mortgage Insurance being waived and getting access to lower interest rates.

What properties are elgibile under the Scheme?

| Properties eligible under all three Guarantee Schemes: |

|---|

| New or Existing house, townhouse or apartment. |

| House & Land Package |

| Land + a seperate contract to build. |

| Off-the-plan purchases. |

All properties for all schemes must fall on or below the property thresholds:

Thresholds for the First Home & Family Guarantee schemes

| State or Territory | Capital City & Regional Centre | Rest of State |

|---|---|---|

| NSW | $900,000 | $750,000 |

| VIC | $800,000 | $650,000 |

| QLD | $700,000 | $550,000 |

| WA | $600,000 | $450,000 |

| SA | $600,000 | $450,000 |

| TAS | $600,000 | $450,000 |

| ACT | $750,000 | $750,000 |

| NT Regional | $600,000 | $600,000 |

| Jervis Bay Territory & Norfolk Island | $550,000 | $550,000 |

| Christmas Island and Cocos (Keeling) Islands | $400,000 | $400,000 |

Thresholds for the Regional First Home Buyer Guarantee

| State or Territory | Regional Centre | All other Regional Areas |

|---|---|---|

| NSW | $900,000 | $750,000 |

| VIC | $800,000 | $650,000 |

| QLD | $700,000 | $550,000 |

| WA | N/A | $450,000 |

| SA | N/A | $450,000 |

| TAS | N/A | $450,000 |

| ACT | N/A | N/A |

| NT Regional | N/A | $600,000 |

| Jervis Bay Territory & Norfolk Island | N/A | $550,000 |

| Christmas Island and Cocos (Keeling) Islands | N/A | $400,000 |

Regional centres are Newcastle and Lake Macquarie, Illawarra, Geelong, Gold Coast and Sunshine Coast.

To further check if the price cap for your desired postcode(s), check out the Governments Postcode tool.

Applying for a Home Guarantee Scheme

The only way to apply is through a participating lender or their austhorised representitives i.e. a Mortgage Broker. Currently, Commonwealth Bank & NAB are the only two major lenders participating in the scheme. There are a large number of smaller lenders participating. You can find a full list of participating lenders here.

The application process is no different from the usual home loan process, you'll just need to ensure you're eligible and provide a few extra documents:

| Extra documents required to apply for the scheme: |

|---|

| Medicare Card |

| Most recent year's Notice of Assessment (available in MyGov Inbox). |

| Proof of Citizenship / Permanent Residency. |

| Home Buyer Declaration. |

| For Family Home Guarantee: Dependant's Birth Certificate. |

The participating lender will then check your eligibilty and reserve you a spot in the appropriate scheme when your home loan application is assessed. The scheme places can be reserved when applying for a pre-approval.

You must meet all other standard criteria for the participating lender. You must also be able to cover all costs other than your deposit - for a full breakdown of other costs, see this article about the costs of buying a house.

Notes about your deposit

You must have a 2% or 5% deposit of your own - which should be considered genuine savings. This means the funds are your own savings or investment. If you use a loan, gift, or other source, you would need to hold the deposit for a minimum of 3 months to be eligible.

You can use the First Home Owner's Grant to increase your deposit & therefore decrease your loan amount & ongoing payments.

What other schemes are available

Other than the three Home Guarantee Schemes, the following incentives/schemes may be applicable to you:

| Other Government Schemes available: |

|---|

| Stamp duty concessions: full stamp duty concessions available for first home buyers purchasing for under $500k. |

| First Home Owner's Grant QLD: $15k available for eligible purchases of new properties. |

| First Home Super Saver Scheme: first home buyers can make additional Super contributions then redraw to use for their property purchase. |

| Help to Buy: 2% deposit option for eligible buyers under a property-share scheme with the Government. Not yet available. |

Need more information?

We can assist you in confirming your eligibility & explaining all current Government schemes, and assist in reserving a spot on the Home Guarantee Schemes. To learn more about us and our home loan process or why you should choose us as your Mortgage Broker, check out our Mortgage Broker Brisbane page.

| Other information that may be helpful: |

|---|

| The cost of buying a house in QLD |

| How much deposit to buy a house in QLD |

| The home loan process |

We can assist you in applying for a Home Guarantee Scheme spot..

If you'd like us to check your home loan eligibility and provide you with your options, please submit an enquiry through the contact form.

Enquiry Form

FAQ:

How much deposit do I need?

5% under the First Home Guarantee or Regional Home Guarantee. 2% under the Family Home Guarantee.

How many spots are available?

First Home Guarantee: 35,000. Regional Home Guarantee: 10,000. Family Home Guarantee: 5,000.

How do I apply for the Home Guarantee Schemes?

Through a Mortgage Broker or participating lender.