Fixed vs Variable vs Split Home Loans

Fixed, variable and split home loans are the 3 ways to set up your repayment types. As a basic overview:

- Variable home loan: The rate can be increased/decreased at any time by your bank. Whilst they usually go up/down with the RBA rates, that's not always the case. They are generally more flexible, can include redraw/offset accounts and consistute the majority of all home loans in Australia. Exit fees are regulated and limited to the 'reasonable amount the Lender would incur by closing the facility', which is generally $400 or less.

- Fixed home loan: The rate is fixed for a period of time; generally 1 - 5 years. The advantage is certainty of repayments, however they don't get all the features of a variable rate, are limited on extra repayments, and can incur significant break fees if you try to pay it out early (refinance, sell or pay off).

- Split home loan: A combination of variable and fixed. To clarify: your home loan is literally split in 2 (or more), so it'll appear you have both a variable and fixed home loan in your internet banking. Best of both worlds, with some drawbacks.

For those that don't want to read much into it or do too much research: I'd recommend a variable rate as a safe and flexible option. The important thing to understand is that your rate can (and will) go up and down somewhat regularly, which will change your repayments.

We'll talk about split home loans a little later on.

Advantages of Variable vs Fixed Mortgages

Each come with their own advantages. We won't go through disadvantages as their generally just the inverse.

| Advantages of a Variable Loan: |

|---|

| Generally cheaper, on average (explained further down) |

| Ability to add redraw and/or offset account |

| Low ($400 or less, generally) exit fees |

| Less 'revert rate shock' (explained further down) |

| Advantages or a Fixed Loan: |

|---|

| Certainty of repayments |

| Easier budgeting |

Again, split loans will be talked about seperately, as they are a combination of the two.

Variable Home Loans

Variable home loans are the most common type of home loan. The rate can be moved up/down by the bank at their discretion (although it usually follows the RBA's rate decisions) which will increase/decrease your repayments appropriately. I read somewhere that Australian's have about 80% of home loans variable (don't quote me on that figure). They're usually split into Basic or Package/Professional/Offset. The general differences are:

- Basic Home Loans: Generally come with Redraw as a feature and no other features. Generally $0 p.a. fees. Overall, can be cheaper depending on the rates.

- Packaged/Professional/Offset Home Loans: My personal preference. Rates are often very similar (sometimes cheaper, sometimes more expensive, depending on the bank). They almost always come with annual/monthly fees ranging from $96 p.a. - $395 p.a.. They all (I think) include one or multiple Offset Account(s). The 'packaged' products often come with a Credit Card and sometimes insurance discounts.

I prefer to use the Packaged Variable for my own home loan as I like to use a Credit Card to reduce interest, and an offset account for security & convenience.

Variable rate home loans provide extremely flexible options for extra repayments, allowing infinite additional payments. When you pay out the loan in full (by repayments, refinancing or selling), the lender can only charge you a Discharge Fee which is defined as "a credit fee or charge that only reimburses the credit provider for the reasonable administrative cost of terminating the credit contract". This is almost always $400 or less, although some of the non-banks charge higher.

What's to stop my bank raising rates unduly?

Bank's can raise rates out-of-cyle and/or at any time, really. The great part about variable home loans is that the costs to refinance are always minimal. So if your Bank stops being competitive, you can simply move elsewhere (subject to lending criteria etc.).

Fixed Rates

Fixed rates generally don't allow offset accounts or redraw. You can usually make extra repayments, but they're heavily limited; often to about $10,000 extra per year. Certainty-of-repayments is definitely an upside, but you definitely need to be aware of 'rate-revert-shock'. If rates are rising heavily above your fixed rate, you'll have a sudden increase in repayments when your fixed rate ends, so it's generally wise to ensure you're comfortable with these repayments, as those on a variable rate loan will become slowly adjusted to the higher repayments over time.

If considering a fixed rate, it's important you understand Rate-lock before proceeding, as it can have a large impact on your home loan. In short: if you don't pay a rate-lock fee, you'll get the lender's fixed rate that's applicable at settlement, not necessarily the one you applied for.

One major downside to Fixed Rate Home Loans are that you may need to pay break costs if paying the loan out early.

How are Break Fees Calculated?

You can pay off your home loan early, however this can be more costly than paying off a variable rate home loan. On top of the Discharge Fee (usually $400 or less), they can charge you 'Break Costs' which are defined as a reasonable cost "arising from the early repayment, that is a result of differences in interest rates". What this means: if you pay out a fixed rate of 2.99% and current rates are around 6%, you should pay $0 break costs. If you have 1 year left on your fixed rate and you want to pay out a 6% fixed rate when variable rates are around 3%, you'll probably pay roughly 3% of the home loan balance in break fees (i.e. they lost 3% p.a. for 1 year).

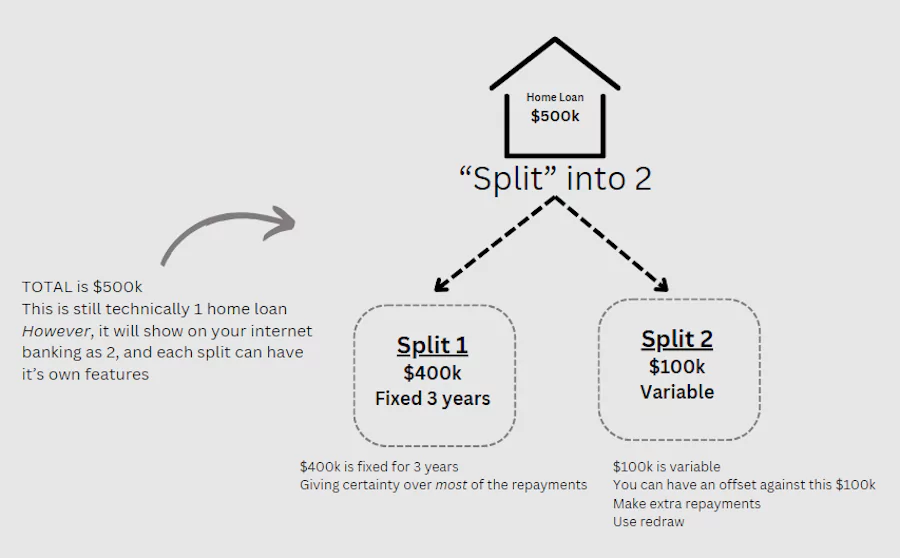

What are Split Home Loans?

A split home loan is when you ask the bank to 'split' your home loan into multiple splits. This is still one home loan, however will show as multiple home loans on your internet banking, and also allows you to have different loan types / features on each split.

In the above example, you can see someone has opted to make $400k (80% fixed) and the rest variable. This is an example, and you can split yours any way you want. I will generally recommend this as a better alternative to a 100% fixed loan, as you can then make extra repayments against the variable split and/or have an offset account, whilst still ensuring 80% of your repayments don't change.

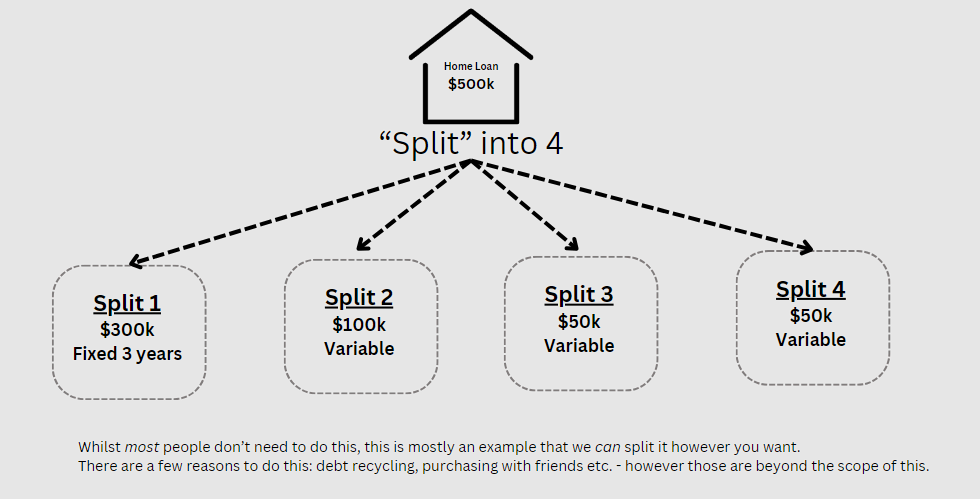

You can split your home loan more than twice if you'd like to. There are reasons to do this, sometimes - such as debt recycling and purchasing with friends, but those are beyond the scope of this article.

Which should I pick?

This comes down to personal preference generally, however I usually pick 100% variable with an offset myself. If you don't need any certainty of repayments, I think variable home loans give you better flexibility and options - so are a great choice. If you do want certainty of repayments or are worried about worst-case scenario (i.e. if rates go through the roof), I'd recommend you consider a split home instead of 100% fixed, if it's a viable option.

Which is cheaper: Variable or Fixed Home Loans

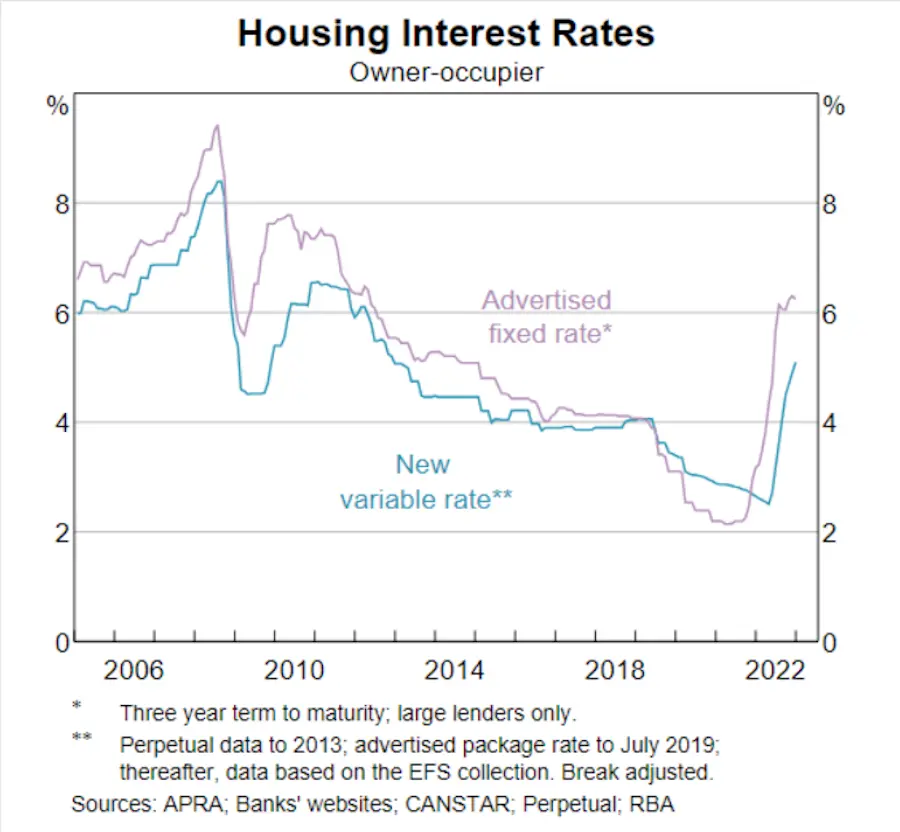

This really depends on when you're applying, but lets look at the historical data.

The above shows 16 years of fixed vs variable rates.

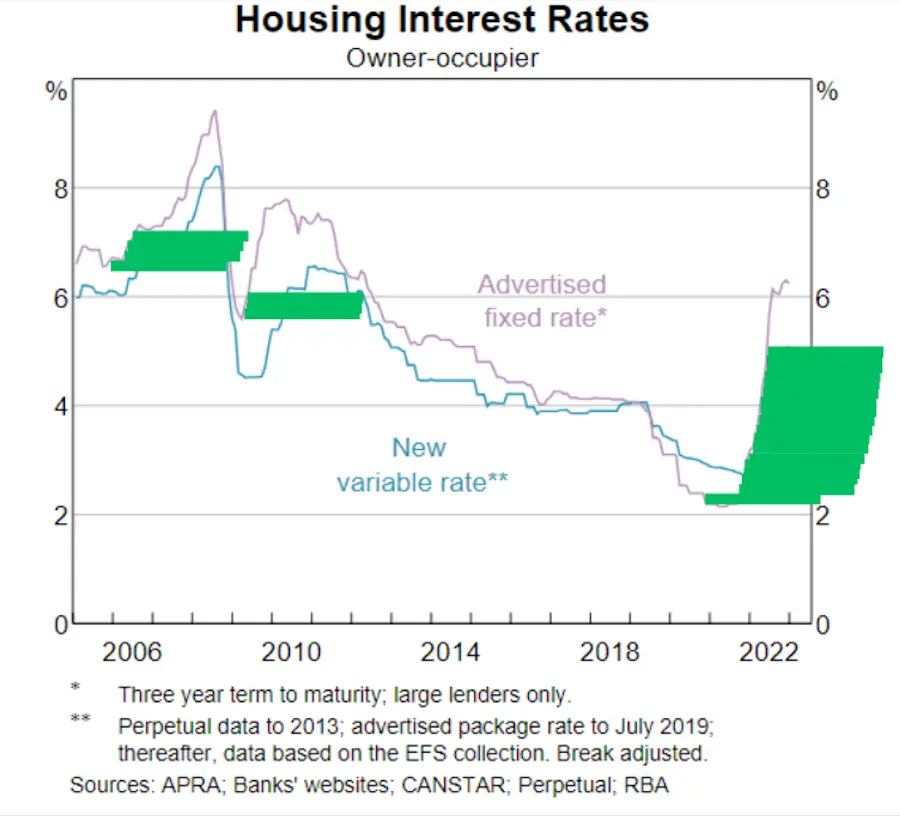

In the above, I've tried to highlight at which points you would have been better off fixing your loan. It shows that you're generally better fixing your loan in a market where interest rates are increasing, which seems fairly intuitive; with the inverse also being applicable. The interesting part is that fixed rates are generally more expensive as a whole, including in a flat market. As such, I believe variable rates are likely to be cheaper, on average, over a 30 year period.

Unfortunately the above is the best I can find as far as long-term comparisons - and I know it's not great data by any means.

What will the fixed rate change to?

After the fixed period, it will revert to a variable rate. I generally call this the 'revert rate', which is often set at settlement. When you get your fixed rate, your contracts will include an applicable revert rate (which will increase/decrease with the banks' reference rate). You can often get a decent discount on your revert rate upfront to ensure your variable rate will at least be somewhat competitive. When your fixed rate is almost up, you can also ask the bank in advance (usually within 2 months of the fixed rate ending) to review the upcoming variable rate. If they don't offer anything competitive, you can prepare to refinance.

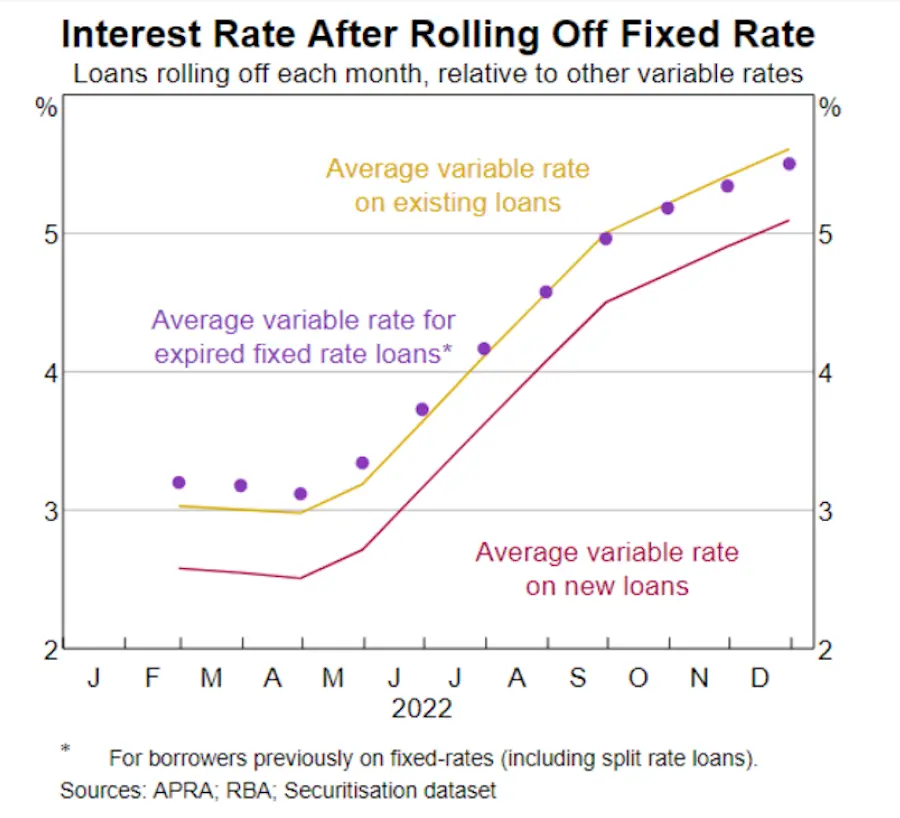

People often worry about getting pushed to a very high variable rate after the fixed rate expires, but the above shows that's not true. Even when the 'comparison rate' shows that your fixed rate will jump to a high variable rate, it's very common that you'll be offered a much better rate when the time comes - sometimes, you just need to ask!

DISCLAIMER: You must not rely on the information in the report as an alternative to financial advice from an appropriately qualified professional. If you have any specific questions about any financial matter you should consult an appropriately qualified professional. We do not represent, warrant, undertake or guarantee that the use of guidance in the report will lead to any particular outcome or result. The content, calculations and opinions contained in this article are of the writer only, and are not necessarily those of Blue Fox Finance. Whilst we take care in ensuring the accuracy of the information, policies are changing regularly and this webpage may not reflect the most recent information.