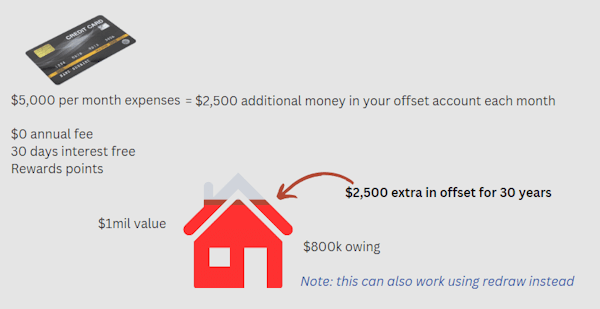

Using a Credit Card with an Offset/Redraw

Using a credit card with your home loan, when done correctly, can reduce the interest significantly over the 30 year period, whilst giving you a significant amount free reward points.

Generally, I recommend that you find a fee free credit card, but you can opt to use one with a fee for extra points/features. You may also have a premium credit card included in your home loan. The other important aspect is that you have 30 days interest free and pay it off in full each month - thereby you can have $0 interest and $0 fees on the card.

The general premise is that you can put your expenses on the credit card at no cost, which lets you retain more funds in your offset account or redraw for the month, thereby reducing interest (variable loans only, usually).

How much can you save?

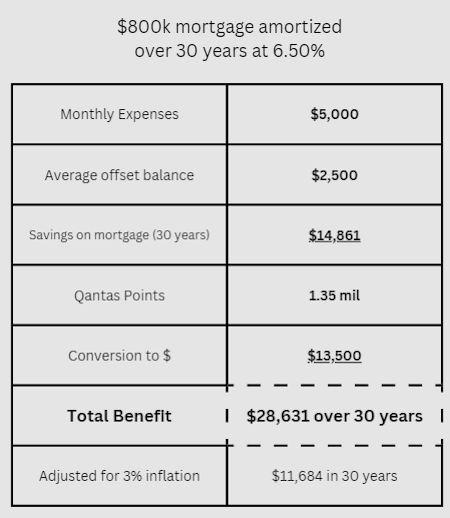

Lets use the below as an example: $800k mortgage, 6.50% interest and $5,000 per month in expenses. As we'll have $0 extra in the loan when we pay the credit card (every 30 days), and $5,000 before we pay the credit card, we'll use an average extra balance of $2,500 for the term of the loan.

The savings on this example end up as $14,861 less interest / mortgage repayments over 30 years.

How many points can I get using the Credit Card?

I only Googled for about 3 minutes to find this, but found a $0 p.a., $0 signup, 44 day interest free period card w/ AMEX which provides QANTAS points. I will note that AMEX may reduce the benefit as some vendors charge a transaction fee, but you can use a free card from your home loan (if applicable) or spend the time to find an option that suits you better. I've used the QANTAS Amex Discovery Card for my calculations.

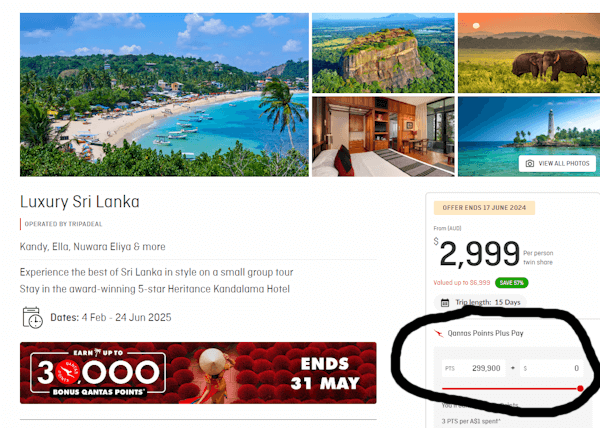

With $5k spendings p.m., you'd get 1.35mil Qantas Points over 30 years. Some people value these points around 1c - 3c per point. Using this method, you'd get about $13,500 to $40,500 in value. I instead opted to go have a look for a nice holiday and see how it actually converts. I had a look at current Qantas deals and found myself a nice Luxury Sri Lankan 15 day holiday with Return Flights and a 5 start hotel included. Using only points, this comes to just 299,900 points. Whilst it says "Valued at $6,999", we'll use the discounted cash price of $2,999 because we're not suckers for marketing ploys.

We can go on this 15 day, all inclusive, luxury holiday 4.5 times over the 30 year term, without paying for anything other than spending money and food! If we use these figures to convert our points, we still get $13,500 in value ($3,000 holiday x 4.5 = $13,500).

This brings the total benefits to about $28,631 over 30 years ($14,861 less interest and $13,500 in holidays or other rewards). Even if we adjust for 3% inflation over 30 years, that's still $11,684 in today's money, all completely free if we choose a fee free credit card and pay it off before incurring any interest.

Which banks offer credit cards with a home loan?

The below list is changing all the time, so be sure to double check. Also, the banks listed as "don't offer a credit card", generally do offer credit cards, they just don't generally waive the fee on the high rewards card as part of your home loan.

| Common banks offering credit cards with a home loan: |

|---|

| CommBank |

| BankWest |

| Macquarie |

| Suncorp |

| Westpac |

| St George |

| Banks that don't offer free credit cards with a home loan (usually): |

|---|

| NAB |

| ANZ |

| ME Bank |

| ING |

Note: the credit cards offered are generally not with any home loan. They're usually included in that lender's 'package' product, which often comes with an offset account also.

DISCLAIMER: You must not rely on the information in the report as an alternative to financial advice from an appropriately qualified professional. If you have any specific questions about any financial matter you should consult an appropriately qualified professional. We do not represent, warrant, undertake or guarantee that the use of guidance in the report will lead to any particular outcome or result. The content, calculations and opinions contained in this article are of the writer only, and are not necessarily those of Blue Fox Finance. Whilst we take care in ensuring the accuracy of the information, policies are changing regularly and this webpage may not reflect the most recent information.