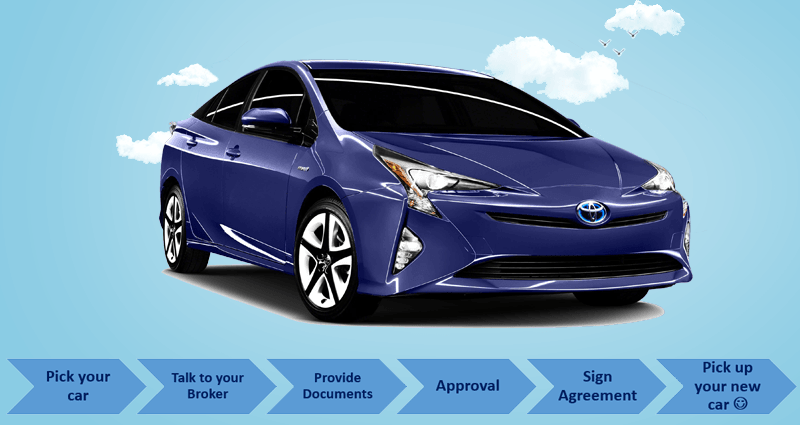

Our Car Loan Process Explained

First step: talk to us about your car financing options.

Send me an email at zak@bluefoxfinance.com.au or use our enquiry form. I’ll come back to you with what we need to get the process started. In most cases, we’ll need:

- Fact find: this provides us with your basic contact details, employment, income & expenses.

- Sign our Credit guide & Privacy disclosure.

- Your latest 2 payslips

- Driver License

Once you’ve sent through these documents, we’ll need about 24 hours to review and come back to you with quotes. If we foresee any issues, we’ll talk about them at this stage.

If all looks good for an approval, we’ll come back with 5 lender quotes for your review. An example of what you’ll be provided can be found here.

Submitting your car loan application

Once you’ve reviewed your options and let us know how you’d like to proceed, we’ll provide you with a Credit Proposal outlining all fees, interest rates and repayments in a formal document. We may need extra documents at this stage, depending on the specific lender requirements.

Once you’ve signed the Credit Proposal, we’ll get the loan application submitted on your behalf and follow-it through to approval.

Loan approval

Once your loan is approved (usually within 24 hours or so), you’ll need to prepare for settlement.

If you haven’t already found a car, you will need to find one at this stage.

Car Loan Settlement Process

Settlement is generally different depending on how you’re buying your car:

- For a dealership sale: you generally will only need to provide us with the finalised car invoice.

- If it’s a private sale: you’ll need to provide additional documents based on the lender’s needs. These usually include: seller’s photo ID, registration certificate, private sales invoice, insurance certificate, seller’s proof-of-banking photos of the car being purchased.

Once you’ve got the required documents together and emailed them through, the loan contracts are usually generated within a few hours.

You can then review and sign your loan contracts. Once signed settlement should occur within the next few hours.

Assuming everything is provided upfront, the whole settlement process should be completed within about 24 hours.

Collecting your vehicle

Once the funds have been transferred, you’ll be okay to collect your vehicle from the seller. If this is a private sale, the seller will need to transfer the car into your name at QLD Transport. If it’s a dealership sale, they should be able to finalise all outstanding paperwork with you on the spot.

Car Loan Process FAQ:

Can you get a pre-approval for a car loan?

Yes - you'll need to complete all documents upfront and get it reviewed by the lender.

How long does a car loan settlement take?

Assuming the loan is already approved, usually 2 - 24 hours.

How is the vehicle verified?

Some lenders still accept pictures + rego etc. Most lenders now use software such as Verimoto - where the seller takes photos of their ID, the car, the rego etc.

Are car loans fixed or variable interest?

Almost always fixed.

Should I pay a deposit on the car before seeking finance?

If you are required to put a deposit down, it's highly recommended you get a pre-approval first.