Help to Buy Scheme

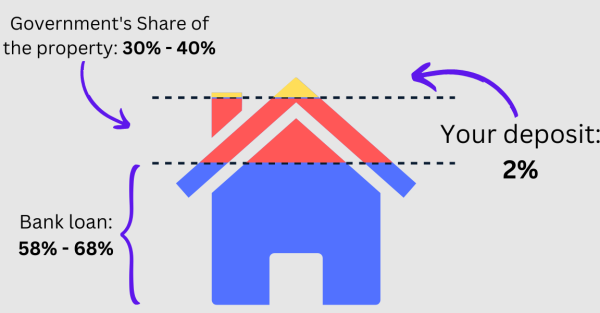

The Help to Buy Scheme is a Labor Government incentive which allows first home buyers (or second home buyers without a current property) to purchase with only a 2% deposit. The Government will then fund and own 30%-40% of the property.

This will then allow the home buyer to get into the market quicker with a lower deposit, lower income, and lower ongoing home loan repayments. The applicant can then choose to buy the Government out at a later date.

Advantages of the Help to Buy Scheme

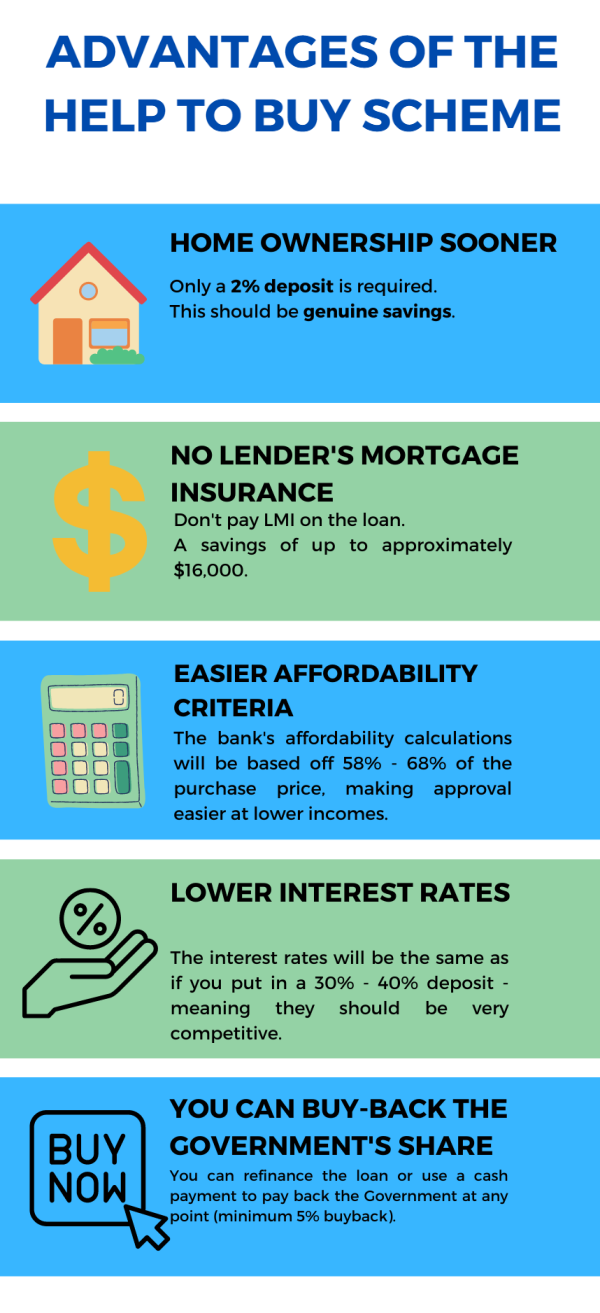

The main advantage is that it will get you into home ownership sooner. This can be broken down into a few points...

Eligibility for the Help to Buy Scheme Australia

| Expected eligibility criteria for the Help to Buy Scheme |

|---|

| Income of less than $90,000 p.a. for a single applicant, or $120k for joint applicants. |

| Must be purchasing a property to live in & must not currently own a property in Australia or overseas. |

| Must be over 18 years of age. |

| Must be an Australian Citizen. |

| Must have a 2% deposit. |

There will only be 10,000 spots made available initially.

The Scheme is expected to run for 4 years, with 10,000 spots available each year, for a total of 40,000 spots.

These places will be released to individual participating States & Territories on a per capita basis.

Help to Buy Scheme: Expected start date

The vote has been delayed to November 26th 2024 to confirm if it's going ahead. So I assume that it would be a 1st July 2025 start if proceeding.

Vote Delays

The latest update is that the Senate voted to delay the actual vote until 26th November 2024, so we're hoping we'll have a final answer on that date..

How is the $90,000 or $120,000 income threshold calculated / checked?

It's unconfirmed at this stage: neither the Government nor the banks have released their guidelines for verifying income eligibility. Basing our assumptions on previous Government scheme's in the past, we believe your income will be verified using the most recent Notice of Assessment (provided by the ATO after submitting your Tax Return).

For the two years after the purchase, if your income exceeds the threshold in both of these years, your eligibility may be revoked - likely meaning you would need to buy the Government's share of your property back right away.

Can the 2% deposit be a gift or loan?

The 2% deposit will need to be genuine savings - which usually means a deposit you've saved yourself over a period of 3 or more months.

If your funds are from the sale of an asset, tax return, gift or loan; it is likely that you would need to hold the 2% deposit in your bank for 3 months or more to be eligible.

The Government's portion...

How much will the Government contribute under the Help to Buy Scheme?

The Government will contribute up to 30% for an existing property or 40% for a brand new property. They will then own that portion until you sell the property or choose to buy them out at a later date.

Can you buy the Government's portion of the property back?

Yes - you can buy it back at anytime after the first 2 years. The minimum buy-back amount is 5% & can be done using cash or by applying to refinance your home loan to pay back the Government.

What if you sell the property for a profit or loss?

At this stage, it's believed you will only pay back the amount the Government originally contributed. This means any capital gains or losses will be 100% worn by you. The Government may add on interest to keep up with inflation - but this is unknown at this stage.

Expected application process for the Help to Buy Scheme?

Most likely, the scheme will be made available to a large number of lenders (currently expected 01/07/2023). You can then apply for the Help to Buy Scheme through a Mortgage Broker or directly through the approved lender when applying for your home loan. They will be able to reserve & implement a spot in the scheme for you. You'll need to provide extra documents on top of the usual home loan requirements:

| Extra documents required for the Help to Buy Scheme |

|---|

| Proof of Australian Citizenship. |

| Latest year's Notice of Assessment. |

| Possibly a signed Stat Dec. |

The rest of the home loan process will be identical to a normal home loan process. The affordability calculations should be much less strict when applying for a home loan under the scheme as you will only need to evidence that you can afford to pay for 60% - 70% of the property.

What are the property price thresholds for the Help to Buy Scheme?

The scheme will cover new homes, established dwellings, units/apartments & duplexes that fall below the following price caps based on the lower of the purchase price or valuation.

These figures are taken from ABC News' information on 18/08/2023.

| Region | Price Cap |

|---|---|

| Sydey & NSW Regional Centres | $950,000 |

| Regional NSW | $750,000 |

| Melbourne & Vic Regional Centres | $850,000 |

| Regional Vic | $650,000 |

| Brisbane & QLD Regional Centres | $700,000 |

| Regional QLD | $550,000 |

| Adelaide | $600,000 |

| Regional SA | $450,000 |

| Perth | $600,000 |

| Regional WA | $450,000 |

| Hobart | $600,000 |

| Regional Tas | $450,000 |

| NT | $600,000 |

| Regional NT | $550,000 |

| ACT | $750,000 |

| ACT | $600,000 |

Can I use the First Home Owner's Grant as my deposit.

You must have a 2% deposit of your own. You can then use the First Home Owner's Grant to increase your deposit & therefore decrease your loan amount & ongoing payments.

What other schemes are available

Other than the Help to Buy Scheme, the following incentives/schemes may be applicable to you:

| Other Government Schemes available: |

|---|

| Stamp duty concessions: full stamp duty concessions available for first home buyers purchasing for under $500k. |

| First Home Owner's Grant QLD: $15k available for eligible purchases of new properties. |

| First Home Super Saver Scheme: first home buyers can make additional Super contributions then redraw to use for their property purchase. |

| First Home Guarantee: using a 5% deposit, the Government will guarantee your loan to avoid you paying LMI. |

| Family Home Guarantee: for single parents, you can use a 2% deposit & have the Government guarantee the rest of the loan. |

Need more information?

We can assist you in confirming your eligibility & explaining all current Government schemes, and pre-assess your situation to make sure you're ready to reserve a spot on the Help to Buy Scheme as soon as they become available. To learn more about us and our home loan process or why you should choose us as your Mortgage Broker, check out our Mortgage Broker Brisbane page.

| Other information that may be helpful: |

|---|

| The cost of buying a house in QLD |

| How much deposit to buy a house in QLD |

| The home loan process |

Please note: the Help to Buy Scheme hasn't been finalised by the Labor Government and the guidelines aren't yet formally available. We have made our best efforts to ensure everything in this article is correct, and will update it as more information is released.

FAQ for the Help to Buy Scheme:

How much will the Government contribute?

30% for an existing property; 40% for a new property.

When will the Help to Buy Scheme start?

Expected 01/07/2023 however unconfirmed at this stage.

How do I apply for the Help to Buy Scheme?

Through a Mortgage Broker or approved Bank.

DISCLAIMER: You must not rely on the information in the report as an alternative to financial advice from an appropriately qualified professional. If you have any specific questions about any financial matter you should consult an appropriately qualified professional. We do not represent, warrant, undertake or guarantee that the use of guidance in the report will lead to any particular outcome or result. The content, calculations and opinions contained in this article are of the writer only, and are not necessarily those of Blue Fox Finance.