First Home Super Saver Scheme

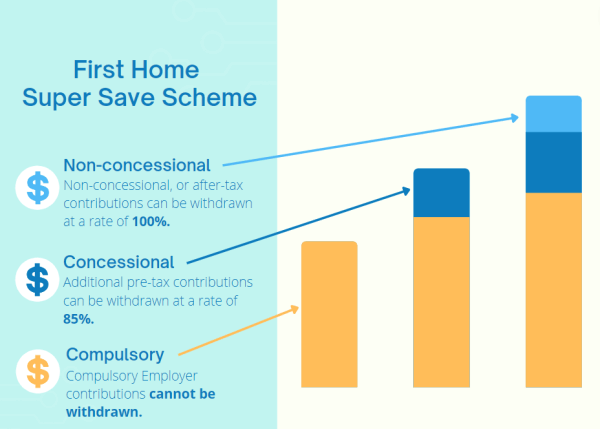

The First Home Super Saver Scheme is a Government incentive allowing first home buyers to withdraw additional Superannuation contributions to allow them to purchase a home. The rate of withdrawal varies but is generally tax effective when combined with additional concessional Superannuation contributions.

You can setup salary sacrifice for long-term savings, or 'recycle' your deposit through your Super close to tax time to increase your available deposit (or a combination of both).

The Advantages of the First Home Super Saver Scheme

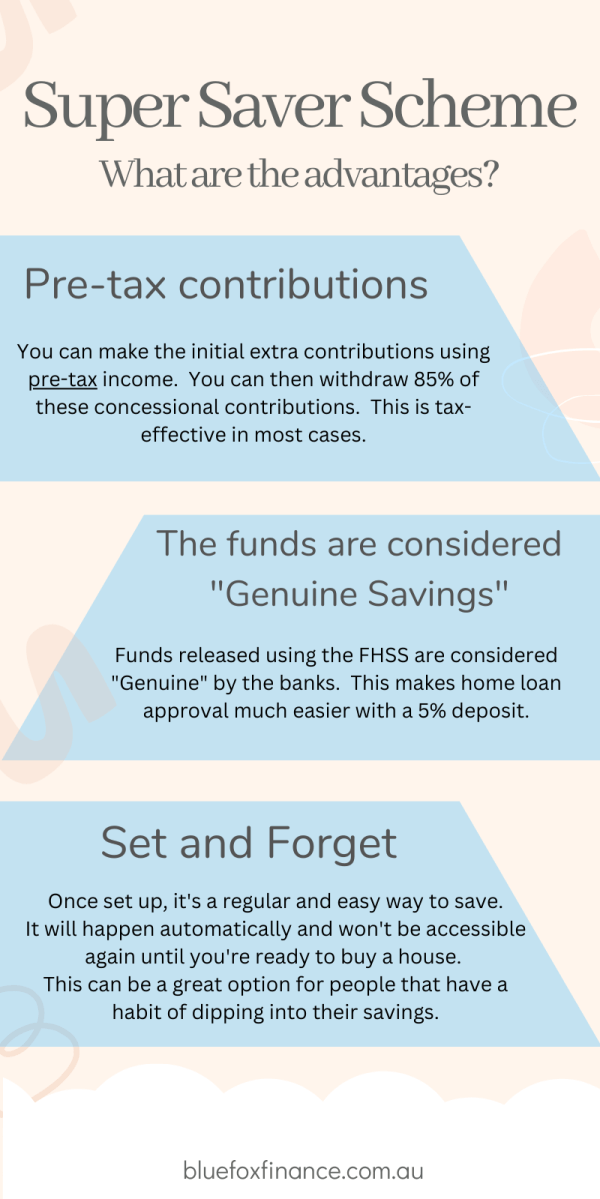

The primary advantage is that you can make pre-tax contributions and withdraw at a rate of 85%. This will then be considered 'genuine savings' by the banks and can be used as your home loan deposit.

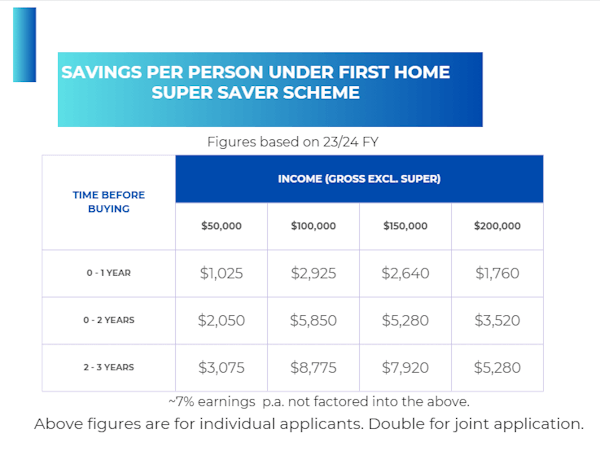

Savings possible through the FHSS Scheme

The amount you'll save using the FHSSS vary depending on a number of factors, including: how many applicants (double the benefit for joint applications), taxable income / marginal tax rate, amount you contribute. The below table shows estimates for a nuber of circumstances. The ~7% earnings on the contributions are not included in these figures (see down page for more details on the SIC rate), and these savings are purely a tax break which you can get very quickly. To acheive these savings, you don't need to have set this up in advance (although it does help), as you can make a post-tax contribution and get cash-back on your Tax Return to increase your deposit. I'd strongly recommend watching the video in this page for a full breakdown of how to get this done..

Eligibility criteria for the Super Saver Scheme

Eligibiility is fairly straight forward for the applicant, with the 'additional contributions' criteria being a little more complex.

| Applicants for the First Home Super Saver Scheme must: |

|---|

| Never have owned a property in Australia |

| Not have previously made an FHSS release request under the scheme |

| Occupy the premises you buy or intend to do so as soon as practically possible |

| Move in for 6 months of the first 12 months after purchasing. |

| Be over 18 years of age. |

| Do not need to be a Citizen or PR. |

| Guidelines for the Superannuation withdrawal: |

|---|

| Compulsory Employers contributions & spousal contributions are not eligible. |

| Additional contributions made before 01/07/2017 are not eligible. |

| Voluntary concessional (pre-tax) contributions can be withdrawn at a rate of 85% of the contribution. |

| Non-concessional (post-tax) contributions can be withdrawn at 100%. |

| You can withdraw up to $15,000 of your additional contributions per financial year, of $50,000 total. |

| You can only release the funds once and then have 12 months to purchase a property. |

Making your Super contributions

You can make your contributions a few ways. Salary Sacrifice is the simplest way and quickest way to realise the benefits, although you'll see the same benefit whichever way you do it.

The ATO recommends you check with your Super fund that you can release the funds under this Scheme, before making any extra contributions.

| Ways to make your FHSSS Contributions: |

|---|

| PAYG: Salary Sacrifice your pre-tax dollars. You need to ask your Employer to set this up. |

| PAYG: Post-tax contribution into your Superannuation fund. You then claim this as a deduction (if concessional) on your tax return and get the benefit through a tax return. |

| Sole Trader: As a sole trader is generally receiving pre-tax dollars and pays income tax quarterly / annually, you can make a contribution then claim it on your tax return. |

| Company: Can use any of the methods depending on how you pay yourself. Talk to your Accountant. |

Using your Existing Superannuation as a deposit.

I've managed to help a few clients find part-of, or even an entire deposit within their Superannuation. To be clear: Employer contributions are not eligible for release. However, many people have made additional contributions without realising. This is often Government Employees, as the Government often mandates/recommends employee contributions, which are eligible. If you've been doing this for a number of years, you may have a sigificant sum available. I'd recommend everyone getting an ATO Determination (explained towards the bottom of this page) regardless, as people often find funds available there, and it only takes 2 minutes to check.

How Concessional Superannuation contributions work

Concessional Superannuation contributions are beneficial because the are taxed at only 15% instead of your income tax bracket. Concessional contributions include employer contributions, but only your additional contributions can be used for the Super Saver Scheme:

| Compulsory Employer contributions |

| Additional Employer contributions |

| Salary sacrificed (pre-tax) contributions. |

The current cap for concessional contributions is $27,500 per annum ($30,000 from 01/07/2024). Any amount over this will be a non-concessional contribution and taxed at your income bracket.

Benefit of Salary Sacrificing for the FHSSS

Salary Sacrificing is the ideal way to use the Scheme, if planned in-advance sufficiently. This is because you get the tax discount immediately each pay cycle, which gives you the maximum benefit at any time (without waiting for Tax Time).

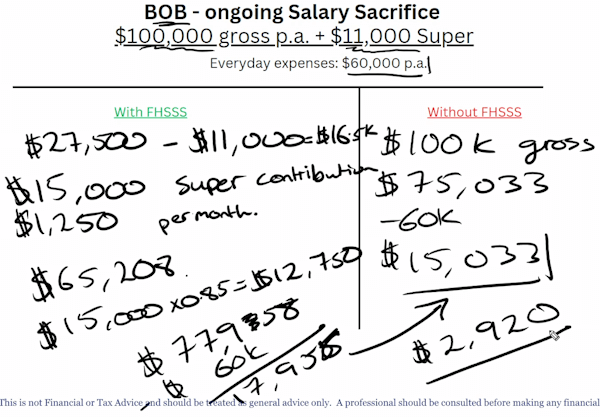

If you take $100k gross + Super, for example. Without the FHSSS, you'll have $75,033 after-tax each year. If you Salary Sacrifice $15,000 p.a. into Super for this Scheme, you'll instead be left with:

- $65,208 after-tax cash

- $15,000 extra in Super, of which you can withdraw $12,750 for your first home (85% of $15,000)

- Thus giving you a total of $77,958 p.a., an increase of $2,920 per year (per applicant!)

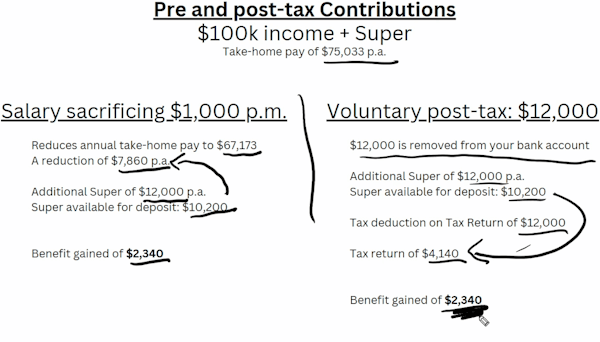

Pre-Tax vs Post-Tax Contributions under FHSS Scheme

The benefit for pre-tax or post-tax contributions is the same, you just see the benefit at a different time. Pre-tax deductions get you the benefit immediately, where as you won't see the benefits of the post-tax contributions until you get your next tax return.

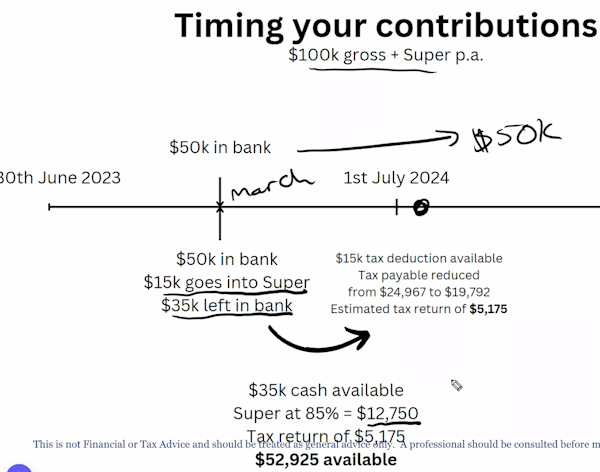

Making EOFY Contributions (post-tax)

If you make post-tax contributions, you'll increase your tax return. You can see the rough math below to see how you can increase a $15k deposit to a $17,925 deposit, just by doing this. The below is a screen grab from the video, which may be hard to understand. I'd strongly recommend watching the video if you're considering doing this.

Calcuating the ideal Superannuation Contribution for the Scheme.

Working off the current $15k p.a. cap for the FHSSS and a Concessional Cap of $27,500 (noting $30,000 from 01/07/2024), here's a few examples of how to calculate what you could contribute. I'd strongly recommend using this Pay Calculator for your calcs.

- $50k + Super gross income: Employer Super of 11% i.e. $5,500 p.a. As the Concessional Cap is $27,500, you can make another $22,500 Concessional Contributions in 1 financial year. As the Scheme is capped at $15,000, $15,000 would be the ideal amount. This can be a $15,000 post-tax contribution, $1,250 monthly salary sacrifice, or combination of the two.

- $150k + Super gross income: Employer Super of 11% i.e. $16,500 p.a. As the Conessional Cap is $27,500, you can make another $11,000 in Concessional Contributions in 1 financial year. The Scheme cap is $15,000. As such, I'd look at $11,000 p.a., which could be $11,000 post-tax, $916.7 p.m. pre-tax salary sacrifice, or a combination of the two.

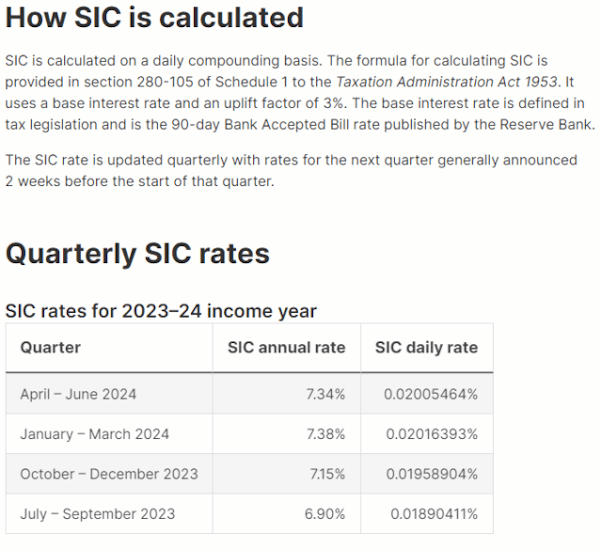

What are the Associated Earnings on your Super?

The associated earnings available for release under the Scheme are not related to your Super's performance. They are instead based on the balance of the contribtions and the earnings at the SIC Rate (7.34% at time of writing). So any savings in your Super that will be released will generally be earning more interest than if it were in a high interest savings account.

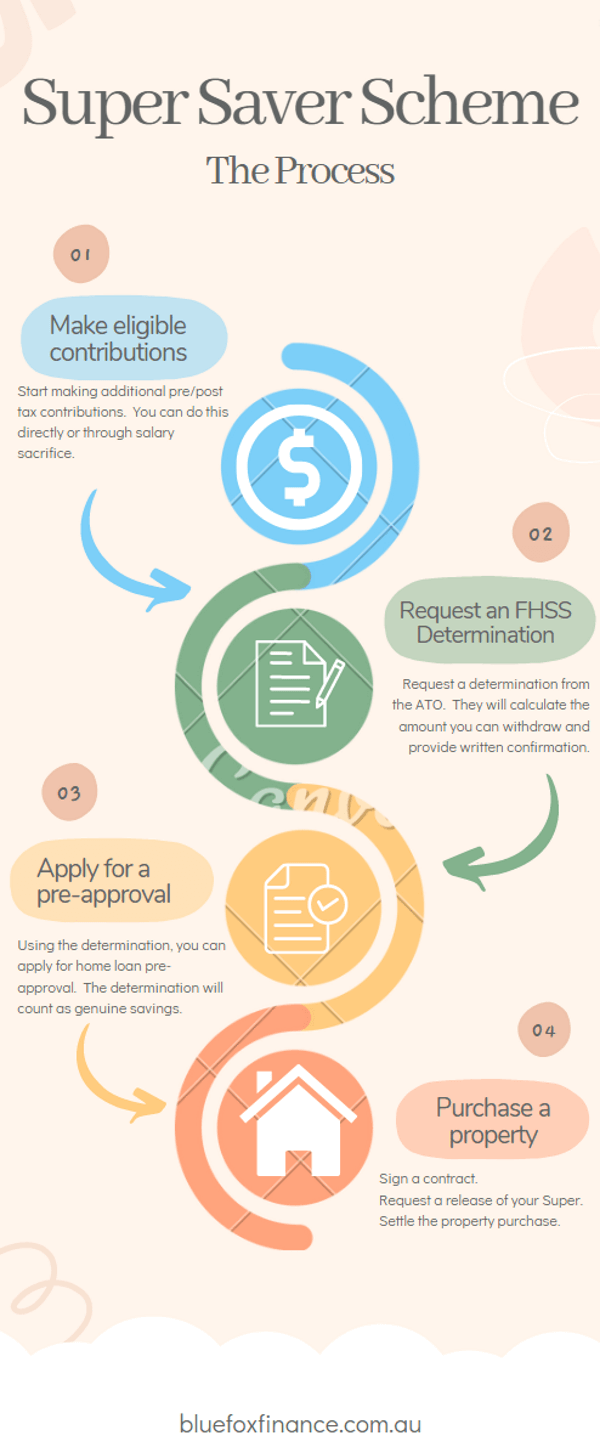

The process for getting your FHSS release & purchasing your property

As a first step, you'll need to set up your additional contributions. Note: you do not need to specifically set them up for the First Home Super Saver Scheme - so any previous additional contributions you've made may be eligible. Ideally, you would set up a salary sacrifice arrangement through your employer to make pre-tax additional contributions. Some employers do not offer this, in which case you can make post-tax contributions direclty with your Superannuation fund.

You then must apply for an FHSS Determination. You can do this via your ATO portal in MyGov. After applying for a Determination, you'll be provided a letter from the ATO to confirm the exact amount you're able to withdraw. You can use this letter as proof-of-savings for your home loan application.

Once you have your determination, you can apply for a pre-approval. This is an optional step - you can instead go straight into purchasing a property and applying for a formal approval. The home loan process won't be any different to normal, but you can use your Determination as proof of your deposit - this will also be considered 'genuine savings'.

Finally, you can purchase a property and prepare for settlement. Once you've signed your contract, you'll need to apply to the ATO to release your Super Saver Determination amount whilst simultaneously finalising your home loan approval. The FHSS amount will be deposited into your bank account within 25 business days, which can then be used to finalise the settlement.

If the property purchase doesn't procees

If the property purchase doesn't go ahead for any reason but you've already received your FHSS funds, you will have 12 months to find and complete another property purchase. If you don't do so within the 12 months, the ATO will grant you an automatic 12 month extension. You may instead choose to re-contribute your FHSS amount to your Superannuation fund.

How to get an ATO Determination

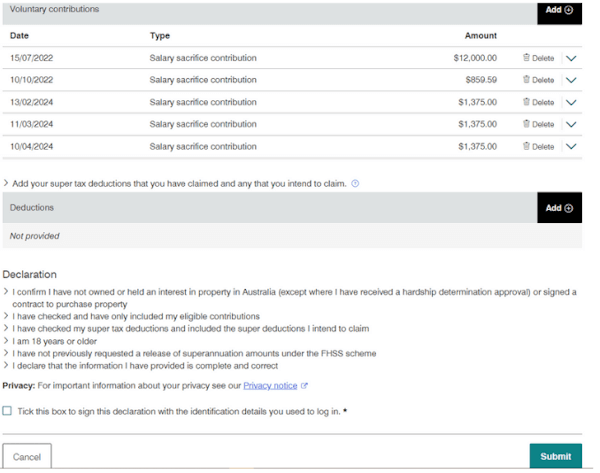

Firstly, head to My Gov > ATO Portal. Up the top, hit "Manage" > "First Home Super Saver" > then follow the prompts. At one stage, you'll get to a page that looks like the below. You'll see all pre-tax contributions (ongoing or one-off) show up there. Please note: they only show up about 7 days after your Employer pays them, which is usually monthly or quarterly. You'll need to manually add any post-tax contributions.

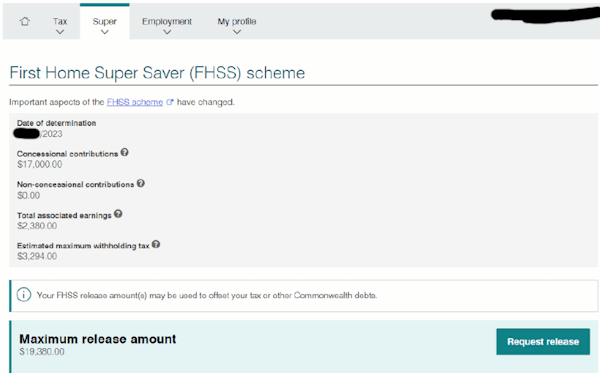

What does the ATO Determination look like?

See below ATO Determination. You can see the breakdown of Concessional contributions, non-concessional, and associated earnings.

Your FHSS release amount(s) may be used to offset your tax or other Commonwealth debts.

You'll notice this information message on your ATO Determination. This does not include HECS (i.e. they won't withold Super to pay your HECS), but can be used to pay any Income Tax Debts, Centrelink Debts or CSA Debts. Source.

Using the FHSS in conjuction with other Government incentives

Using the First Home Super Saver Scheme does not affect eligibility for any other Government FHB incentives. You may also want to consider looking into the other available scehemes.

| Other First Home Buyer incentives available: |

|---|

| Stamp duty concessions: full stamp duty concessions available for first home buyers purchasing for under $500k. |

| First Home Owner's Grant: Lump sum payment available for the purchase or construction of new dwellings. |

| First Home Guarantee: using a 5% deposit, the Government will guarantee your loan to avoid you paying LMI. |

| Family Home Guarantee: for single parents, you can use a 2% deposit & have the Government guarantee the rest of the loan. |

| Help to Buy scheme: purchase with only a 2% deposit under a shared ownership scheme with the Government. Not yet available. |

Need more information?

We can assist you in confirming your eligibility & explaining all current Government schemes and assist you in applying for a pre-approval using your FHSS Determination. To learn more about us and our home loan process or why you should choose us as your Mortgage Broker, check out our Mortgage Broker Brisbane page.

| Other information that may be helpful: |

|---|

| Stamp Duty Calculator |

| Home Loan Repayment Calculator |

| The cost of buying a house in QLD |

| How much deposit to buy a house in QLD |

| The home loan process |

FAQ for the First Home Super Saver Scheme:

What is the main advantage of the FHSS?

The main advantage is that you can make pre-tax Superannuation contributions, then withdraw at an 85% rate to use as your home loan deposit.

What happens to the 15%?

Your Super contribution is taxed at 15% after hitting your fund, so the 15% is lost.

If applying as joint applicants, and only one person is eligible, what then?

The person that's eligible can use this Scheme and make a withdrawal, the other can't.

Can you withdraw the earnings on the contributions?

Yes - but this is at the SIC rate (not the actual earnings).

What if I never buy a house?

Then the funds will remain in your Superannuation, which is generally a sound investment anyway.

Do I need to be a Citizen or Permanent Resident?

No.

Can I use this with a Guarantor?

Yes. However, a Guarantor allows 100% borrowing. You would need to contribute your FHSSS withdrawn funds at settlement (thereby reducing your home loan).

Are previous Super contributions eligible?

Previous contributions are eligible, but they must be additional contributions after 2017 (i.e. not employer/spousal contributions).

How do I apply for the First Home Super Saver Scheme?

The Super contributions can be setup with your employer or Superannuation fund. The Determination & Release should be applied for through the ATO.

DISCLAIMER: You must not rely on the information in the report as an alternative to financial advice from an appropriately qualified professional. If you have any specific questions about any financial matter you should consult an appropriately qualified professional. We do not represent, warrant, undertake or guarantee that the use of guidance in the report will lead to any particular outcome or result. The content, calculations and opinions contained in this article are of the writer only, and are not necessarily those of Blue Fox Finance.