Self Employed Home Loan

Self employed home loan requirements aren't always that much different from a regular application. In general, you will need to meet regular lending guidelines, and supply sufficient financials: tax returns, NOA's (Notice of Assessments) and sometimes BAS and/or a letter from the accountant.

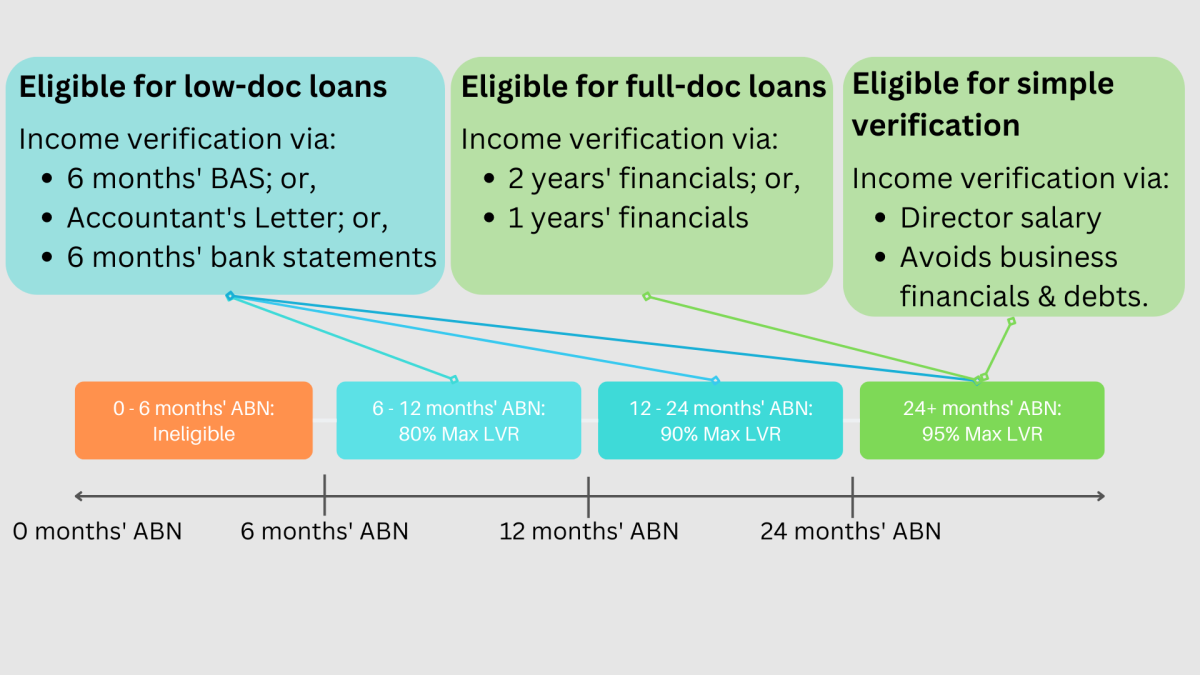

Self Employed Home Loan Requirements are based on how long you've had a registered ABN.

This page is specifically designed to help you understand how self-employed home loans work; if you'd like to know what makes us different, look at our Mortgage Broker Brisbane page. You can see a full breakdown of our home loan process here.

| LVR Requirements for a self employed home loan based on length of employment: |

|---|

| 6 months - 12 months self employed: 80% LVR max. |

| 12 months - 24 months self employed: 90% LVR max. |

| 24 months or more self employed: 95% LVR max. |

| Document requirements for a self employed mortgage: |

|---|

| All applications: Sufficient identification, liability statements |

| 6 months - 12 months self employed: 6 months' BAS or Accountant's Letter. |

| 12 months - 24 months self employed: 6 months' BAS or Accountant's Letter. |

| 24 months or more self employed: 2 years' tax returns and NOA's OR last 4 BAS for Low Doc Loans. |

How we will verify your income for a self-employed home loan

There are two different options: full doc or low doc. Full-doc is usually used for self-employed applicants that have had their ABN over 2 years, however those applicants may still want to apply under low-doc so they can use the most updated financials.

Full-doc income verification

If you've been trading for over 24 months, most banks will want to see 2 full years' financials. They will then use the profit + any applicable add-backs (see below) to calculate your income. There are a few common methods banks will use when calculating your income:

| Most banks will look at the two years' financials and... |

|---|

| Calculate the income on each year separately i.e. profit + add-backs. |

| Take the most recent year's figures if it's lower; or, |

| Take the average of the two years' income if the most recent is higher. Sometimes limited to 120% of the lower year's figures. |

| Some banks will look at one or two years' financials and... |

|---|

| Calculate the income on the most recent year's profit + add-backs. |

| Use this figure for servicing. |

| Some lenders will only do this if we can provide 6+ months of BAS to support the figures. |

Simple verification: using only your salary as evidence

There are banks that offer a 'simple verification' method for self-employed applicants. This means we can use your salary in isolation without needing to look at company financials. Usually, you'll need to have been paid a regular salary from a company/trust structure for 6-12 months. We'll use the following documents to verify your income if this is the best for you:

- Payslips and/or salary credits for 6 months

- A letter from your Accountant to confirm you company is trading profitably, able to meet it's commitments & continue to pay your salary

Using this method, we won't take into account any profit, add-backs or company debts. We cannot use this method for sole-traders.

Add-backs available for a full-doc home loan

Add-backs are figures we can 'add back' to your profit to increase your income for the application. Add-backs include:

| Depreciation: |

|---|

| Ongoing depreciation can be added to your income as a tax-free income in most cases. A depreciation schedule should be supplied for this. |

| Instant asset write-offs in your latest financials can usually be added back as a taxable income. |

| Some banks will limit the depreciation add-back to 120% of your profit figure. Others will use 100% regardless. |

| Salary: |

|---|

| Salary paid to applicants is added back as a taxable income. We evidence this with personal tax returns. |

| Dividends paid to the applicants. |

| Interest: |

|---|

| Most banks will use interest as an add-back to your taxable income. If so, all ongoing loans must be expensed in the affordability calculations. |

| Some banks won't include company debts in affordability, but also won't add-back interest costs. |

Income deductions for full-doc home loans

In some cases, we need to deduct income from your profit (+ add-back) figure. The most common income deductions are:

| One-off incomes: |

|---|

| Most commonly are Government incentives including Covid19 payments & Government Grants. |

| Any income that you don't expect to receive again in future years. |

| Company liabilities including loans & credit limits: |

|---|

| The majority of banks will expense liabilities in full, and add-back the interest. |

| Some banks will ignore company debts, but not add-back interest expenses. |

Low-doc home loans for self-employed

Low doc loans come at a higher interest rate and higher deposit requirements, with less banks offering them. Low-doc loans generally benefit a few types of applicants:

- Applicants who have been self-employed under 2 years.

- Applicants who's full-year's financials don't accurately reflect their income. We can look at using your income averaged over the last 6 months'.

- Applicants who haven't completed their most recent years' financials. Usually, banks require you to have your financial's completed by Jan-March in the following financial year.

How we'll verify your income under a low-doc loan

We can generally verify your income using one or two of the following:

| Documents used to verify your income for a low-doc self employed home loan: |

|---|

| 6 months' BAS (preferred) |

| Accountant's Letter + call to Accountant to verify |

| 6 months' business bank statements |

How different business structures affect your self employed home loan

Company/Trust structure

Company or Trust structures (or Pty Ltd ATF Trust) are common. We will calculate the income (full-doc or low-doc) and then split the income proportionate to the shareholders/beneficiaries. You're usually not considered self-employed if you own less than a 25% stake in the company. Simple verification (using wages only) is possible under this structure. For full-doc loans, company/trusts should provide full Accountant prepared financials including Tax Returns (company & individuals), individual Notice of Assessment, Profit & Loss & Balance sheets.

Partnerships

Under a partnership structure, banks will split the final income figures 50/50 between the partners (which may be both applicants, or one applicant and a third party).

Sole Traders

For a sole trader, the business & the individual must be considered as one entity. Whilst we'll still calculate income the same, business debts must always be expenses (as the loan is technically in the individual's name). Simple verification (i.e. salary only) is not possible for sole traders. Banks don't always require full financials for sole traders, and are usually okay with just personal tax returns & Notice of Assessments.

What happens when you've changed structure in the last 2 years

As a general rule, a change of structure will reset the clock on bank requirements. There are exceptions when we can prove the change is logstical only. The most common exception is when a sole-trader changes to a company: this in generally accepted if the sole trader becomes the sole share holder & Director. It's generally not accepted if the sole trader adds their partner as a director/shareholder - in this case, you'd usually need to wait 12 monhts.

Enquiry Form

Specific self employed home loan requirements based on time-in-employment:

FAQ about our self employed home loan requirements:

How long does it take for an approval?

Our process usually takes 24-48 hours. We have banks that will approve the loan in 24-48 hours for full-doc or simple verification. Low-doc loans usually take 1 - 2 weeks.

How long do I need to be self employed?

6 months: 20% deposit. 12 months: 10% deposit. 24 months: 5%-8% deposit.

Do you charge for your service?

No. The lender pays us a commission for a successful application so you needn't pay us anything.

Do you only service Brisbane?

We can do self employed home loans all over Australia, often over the phone. Our Mortgage Broker is however based in North Brisbane, and as such can service all surrounding areas in person: Albion – Alderley – Ascot – Aspley – Bald Hills – Banyo – Boondall – Bracken Ridge – Bridgeman Downs – Brighton – Brisbane Airport – Carseldine – Chermside – Chermside West – Clayfield – Deagon – Eagle Farm – Everton Park – Fitzgibbon – Gaythorne – Geebung – Gordon Park – Grange – Hamilton – Hendra – Kalinga– Kedron – Keperra – Lutwyche – McDowall – Mitchelton – Myrtletown – Newmarket – Northgate – Nudgee – Nudgee Beach – Nundah – Pinkenba – Sandgate – Shorncliffe – Stafford – Stafford Heights – Taigum – Virginia – Wavell Heights – Wilston – Windsor – Wooloowin – Zillmere.

Will a credit check be required?

We can pre-asses your application without a credit check, however the lender will be required to do one upon application.