Renting Current House & Buying Another

Whilst turning your current house into an investment and purchasing a new place to live seems like a good idea; in most cases, it's not. We'll first go through a brief explanation of how you would do this, then we can look at the math behind it and why you are probably better selling your first property and buying a new investment.

Please consider watching the video as it should explain things more succictly.

How can I use my equity to buy another property

First, the basics: you can borrow up to 80% (or 90%, at a higher rate + fees) against your property and have the equity released as cash. Assuming you have sufficient equity, you would usually pull out a 20% deposit plus enough for Stamp Duty etc., then purchase a new property with an 80% loan.

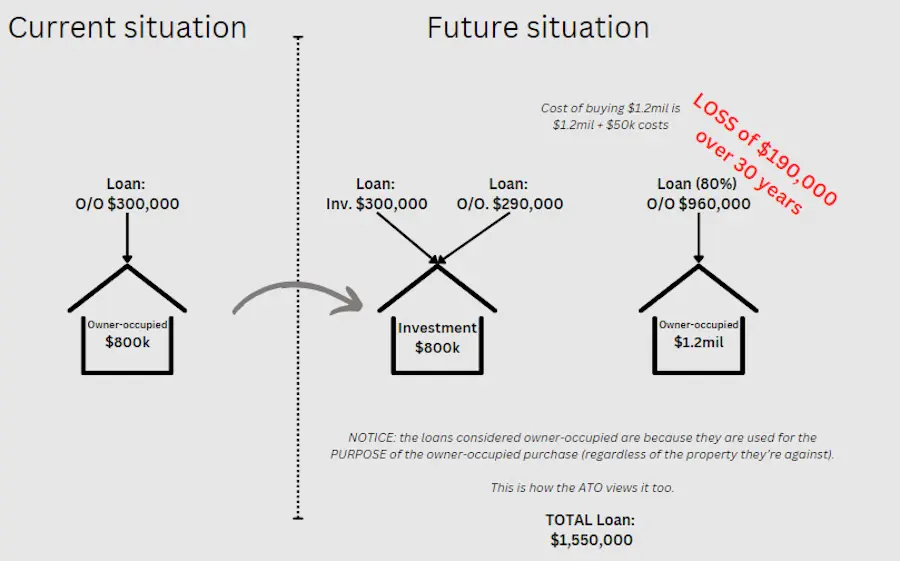

In the above example, we can see the borrower turns their current property into an investment (swapping their current $300k owner-occupied loan to an investment loan), borrows an extra $290,000 against their existing property and 80% against the new property. This gives them $1.25mil in cash to purchase their $1.2mil new home.

An important concept in the above is that the loans are considered owner-occupied/investment based on their purpose, not the house they're secured against i.e. the $290k against the first property is still an 'owner-occupied' (or non-deductible) debt as it was used to purchase an owner-occupied property. This is how the ATO views it too from a tax point of view. This becomes very important later on.

Another concept here is that we end up with essentially 3 loans, which seems weird. This is the best and correct way to do it in 98% of cases. If someone offers you a $300k O/O loan + $1.25mil investment loan, you should not accept it. That's called cross-collateralisation, which looks good, but really isn't. If you need to understand this more, please read this this article about cross-collateralisation to understand in full.

The importance of maximising tax-deductible debt

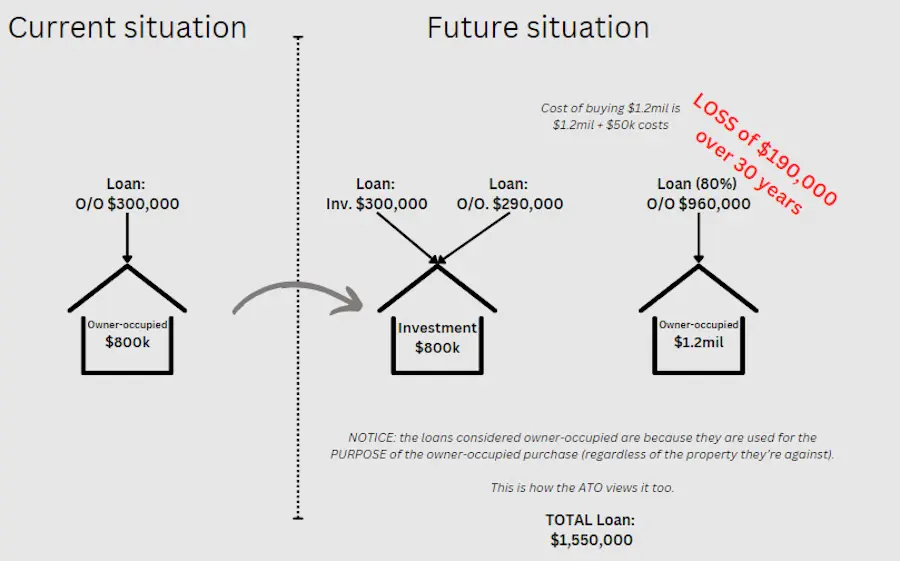

The reason this isn't always great, is you've ended up with a pretty low tax-deductible (investment) debt, and very high owner-occupied debt. Let's have a look at the cash-flow implications for this and how we can improve things:

Because any interest on investment debt is tax-deductible, you can claim the annual interest on the $300,000 here as a tax deduction, thereby reducing your tax payable. Total net income in this scenario would be $136,242 p.a.

How can we do it better?

Let's look at selling the first property and buying a new investment. Most people avoid this because selling costs and stamp duty seem excessive, but it's still worth it in most cases.

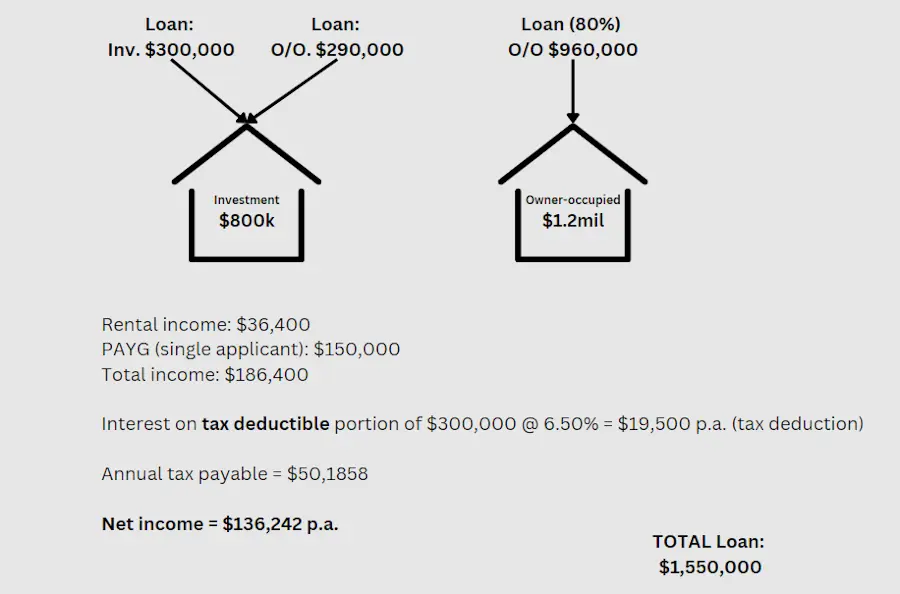

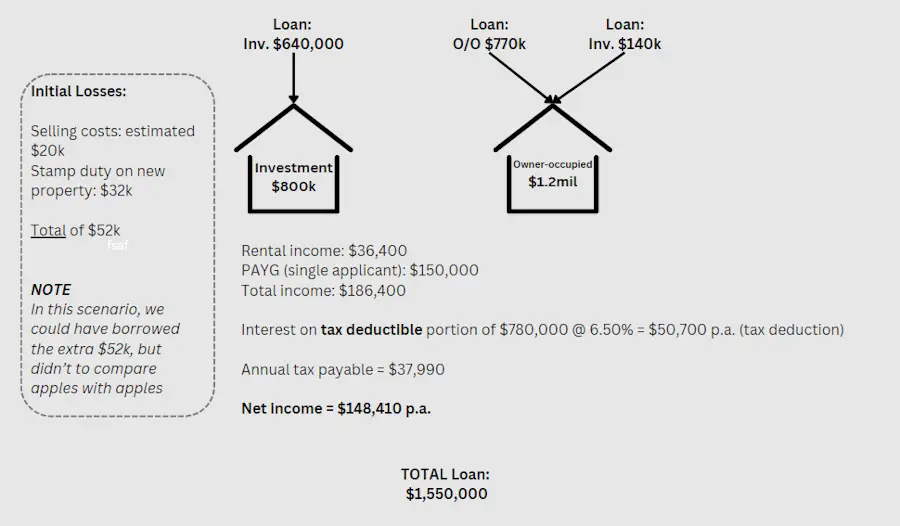

In the above example, we sell our first property and use all our sale proceeds as a deposit on our owner-occupied property. In this example, we would only be borrowing $770k against $1.2mil i.e. 64% LVR. Because we now have equity in our PPOR, we can re-borrow against that to purchase our investment property.

What have we actually done here? We've minimised our non-deductible debt (owner-occupied), whilst maximising our deductible debt. This works because the ATO considers a loan deductible if it's drawn down for the direct purpose of investing.

We reduced our owner-occupied debt to $770k, then borrowed another $780k ($640k + $140k) for the purchase of an investment property, giving us a $780k deductible debt.

Consider that you need to put in $52k cash to cover selling costs and Stamp Duty to buy the new property. Realistically, if you have enough equity, you can/should borrow this also - meaning you end up having over $800k in deductible debt. We haven't done so here so we can compare apples with apples with our cashflow calculations.

Let's look at the cashflow now!

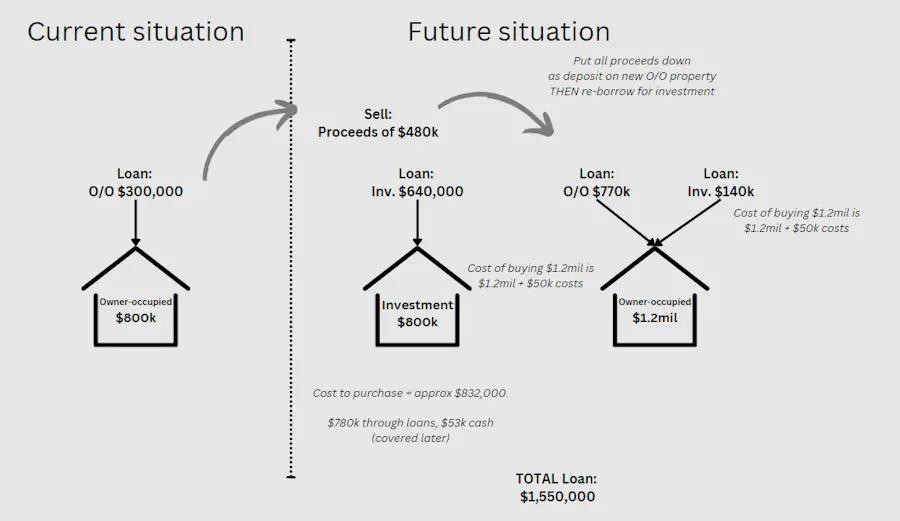

Now that we've maximised our tax deductible debt, we can claim a higher deduction on our tax return and increase our net annual income:

Our deduction on this new scenario is much higher, which means our net annual income is now $148,410 p.a., about $12,000 more than if we kept our original property. And we still own an $800k investment property. What's more, is we can select a property that is better suited to being an investment than the property you own already.

Lets compare the two options

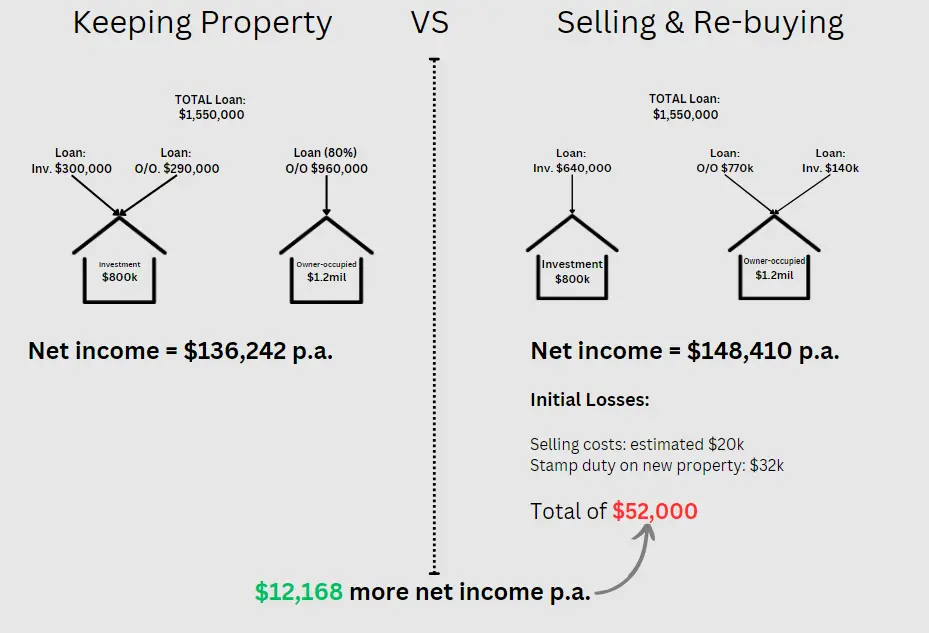

Lets put these side-by-side. On the left: if we keep the first property; the right: if we sell and re-buy.

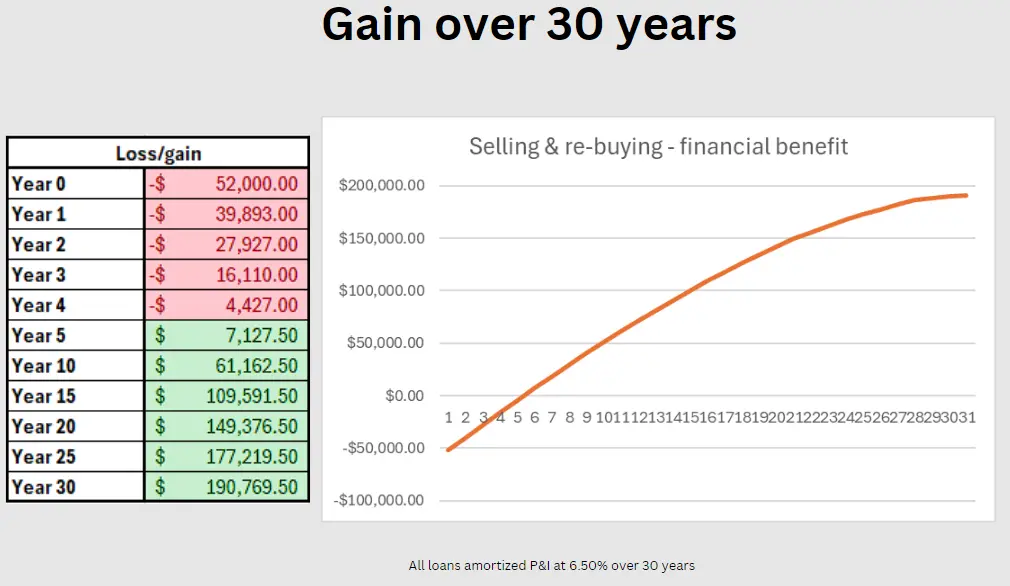

In both scenarios, we end up with the same amount of debt, plus an $800k investment, plus a $1.2mil owner-occupied. It will cost us $52,000 to sell and re-buy (again, you can and generally should borrow this amount), but we're now getting $12,168 more cash each year. It's not quite the full picture though, as the $12,168 benefit p.a. diminishes over time as the loan balance decreases. Nevertheless, here's how it looks when amortizing all of these loans over 30 years:

You get your $52,000 back in under 5 years! The $52k is a one-off amount, but the tax-deduction is ongoing for the life of the loan. Assuming P&I, 6.50%, and minimum payments on all loans, you end up about $190k better off over 30 years.

As a general rule, you'd really want to put the investment loans on interest-only for an initial period and put the additional cashflow into paying down your non-deductible debt - this will further improve the benefits by keeping your deductible debt higher for longer.

When is it better to hold your current property as an investment?

You need to run the figures yourself for starters. Depending on income, property values, loan amounts, rates etc., it may be better to hold the property regardless. If the figures work out similar to the example in this article, you'd still be best to hold the property if:

- You're approaching retirement. In this example, you'd be better off holding the existing property if retiring within about 5 years.

- Your income is likely to reduce drastically. If your income lowers significantly, the benefits of the negative gearing reduce significantly also.

- You have no long-term interest in property investing. If you're planning to sell within 5 years and not re-enter the investment property market, you're better to hold until you sell.

Other considerations

Lets look at the other benefits of selling and re-buying:

| Benefits of not keeping your current property (sell and re-buy): |

|---|

| Tax benefits (as discussed) |

| Selecting a new property. This shouldn't be understated. Most people's first property is a property they live in, not necessarily a good investment property. You have all of Australia to choose an investment property and the one down the road minimises diversification and likely isn't in an ideal location for investing.. |

| Restructing: you can instead look at multiple smaller properties if that better suits i.e. 2 x $400k properties instead of 1 x $800k |

| Restructing: you can consider putting the new properties in a Trust. This makes the calculations on the negative gearing a bit wonky, but has a number of other advantages. Please read this article about purchasing property within trusts to understand more. |

Doing the calculations yourself

Let's look at a few other considerations if doing the calculations yourself:

| Other considerations when figuring out what's best for you: |

|---|

| To simplify things, I haven't considered: other tax deductions (other than interest), changes in interest rates, additional repayments etc. |

| A joint mortgage works a little different, as you'll need to split the tax deduction per the Title (generally 50/50). |

| I've used 6.50% in my calculations. A long-term rate average that's lower will result in a lower benefit of selling, but a long-term rate average that's higher will mean it's more beneficial to sell and re-buy. |

What if I didn't do this?

Generally, it's not too late. If you're already in a position where you've minimized your non-deductible debt, you can usually still fix it by selling the investment property, putting all proceeds into your owner-occupied loan, then getting a new investment loan for a new investment property.

Next steps

We can help with this. We're Mortgage Brokers and can assist in setting your loans up correctly for you - please just make an enquiry through the Contact Page.

Doing the calculations yourself can be easy or hard. We can help by showing you a structure which maximises your investment debt and give the figures on the annual interest in these scenarios, but we can't give tax advice. You'd pretty much just need to take the annual interest in each scenario (loan amount * rate / 100) and put it into paycalculator.com.au as a 'annual tax deduction' (under "Deductions & Other Income"). Include rental income in your gross annual income, then have a look at your "PAY - ANNUAL". You'll see the higher deduction results in a higher annual net pay. In most cases, you'll get a higher tax return resulting in the extra funds in your account, but you can also look at a PAYG Variation to get the benefit throughout the year (talk to your Accountant).

DISCLAIMER: You must not rely on the information in the report as an alternative to financial advice from an appropriately qualified professional. If you have any specific questions about any financial matter you should consult an appropriately qualified professional. We do not represent, warrant, undertake or guarantee that the use of guidance in the report will lead to any particular outcome or result. The content, calculations and opinions contained in this article are of the writer only, and are not necessarily those of Blue Fox Finance.