What are Genuine Savings?

Genuine savings are generally funds that you've held or saved for over 90 days, however other sources can be considered genuine in some cases. Genuine savings are a requirement with the majority of lenders to show that you have the ability to save the deposit yourself and are responsible with money. As the risk lowers (i.e. for higher deposit home loans), the genuine savings requirement is often not required any more.

Note: Genuine Savings is not the same as how much you'll need for the purchase. For a $550k purchase, you may need $43,107 to complete the purchase, yet you only need to evidence $27,500 (5%) 'genuine savings'. See The Total Cost of Buying a House for more details.

When do I need to evidence Genuine Savings?

The majority of lenders want to see genuine savings when you're putting in less than a 10% deposit, however some have higher or lower requirements:

| Lender thresholds for evidencing Genuine Savings: |

|---|

| Home Guarantee Scheme: In all cases. |

| Family Home Guarantee: In all cases - however only 2% gen. savings required. |

| CommBank: Less than a 10% deposit |

| ANZ: Less than a 10% deposit |

| NAB: Less than a 10% deposit or less than 20% if over $50k contribution. |

| Westpac: Less than a 10% deposit |

| St George: Less than a 10% deposit |

| Macquarie: Less than a 15% deposit |

| ING: Less than a ~12% deposit |

| ME Bank: Less than a 10% deposit OR 5% non-repayable gift/inheritance allowed. |

| Liberty: Non-gen savings available for a premium. |

Important note: you only need evidence of 5% genuine savings, if under the above thresholds.

What is considered Genuine Savings?

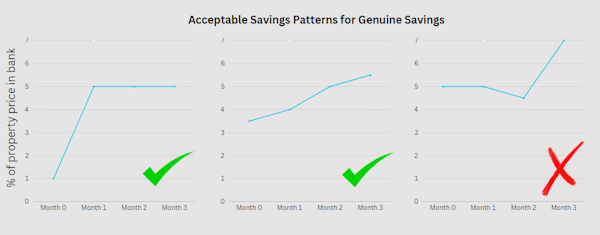

There are a number of sources that are considered 'genuine'. The ideal is simply savings in your bank account where 5% of the purchase price has been held for over 90 days. Many lenders will accept it 'saved over' 90 days, meaning you may have had slightly less than 5% savings 90 days ago, but can show a regular pattern (shouldn't include bulk credits) to get above the 5% requirement.

You'll see option 3 above isn't acceptable as the savings drop below 5% within 90 days. Option 2 is accepted by most lenders even though we started under 5%, as we can show a regular and consistent savings pattern. No issues with option 1 - we don't need a savings pattern if we have the full 5% in the account for 90 days - although I generally would prefer to see savings on top of that.

Other sources of funds can be considered 'genuine' and can make up part or whole of the 5%. I.e. you could show 2% in your bank account for 90 days, plus 3% for another acceptable source.

| Acceptable genuine savings sources: |

|---|

| Savings held for 90 days (all banks) |

| Savings saved over 90 days (most banks) |

| Equity in existing Real Estate (all banks) |

| Sale proceeds from Real Estate (all banks) |

| ATO Determination i.e. funds from the First Home Super Saver Scheme (all banks) |

| Shares/Term Deposit (most banks) |

| Redraw (i.e. overpayments on other home loans that can be withdrawn) (all banks) |

| Tax Return (CBA, ANZ, Suncorp, Westpac) |

| Rental Ledger - described further down (some banks: ANZ, Westpac, NAB, Suncorp) |

| Bonus/Commission (ANZ, Suncorp, CBA) |

| Deposit paid to builder (over 90 days ago) (all banks) |

| Unacceptable genuine savings sources: |

|---|

| Any type of loan other than a home loan |

| First Home Owner's Grant |

| Sale of assets (other than Real Estate) |

| Inheritance |

| Gift (unless w/ Rental Ledger) |

| Large deposits inconsistent with income |

| Gambling winnings |

| Builder / Vendor incentives / cashback |

What documents are required to evidence Genuine Savings?

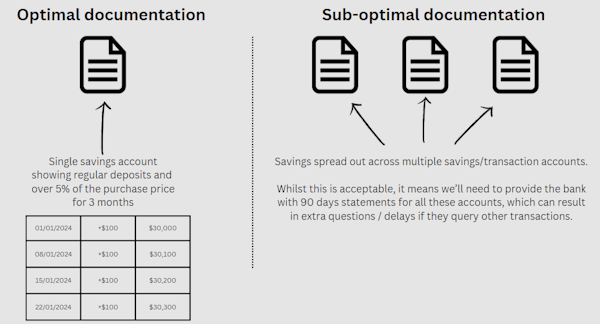

The documents vary depending on the source. Ideally, we'll just show 90 days of one savings account, but we sometimes need to provide 90 days on multiple accounts - which will mean the lender scrutinises those accounts needlessly. If you were using Superannuation through the First Home Super Saver Scheme, then you would provide an ATO Determination. If you were evidencing the sale of shares, you would provide Shares statements - and so on.

Using a Rental Ledger for Genuine Savings.

Some lenders will let you use your rental history as evidence of 'genuine savings'. For example, you may be gifted a 5% deposit, and then show the bank your rental ledger to evidence that you've been able to consistently pay rent over the last 3-12 months. Here's how the different banks look at this:

- NAB: Must be evidenced over 90 days and through a Real Estate Agent or Government Department. Rent payments must equal or exceed the 5%.

- Westpac / St George: Owner-occupied purchases only. Must evidence 6 months' continuour rental payments through a Real Estate Agent. All tenants on the lease must be borrowers. Rent paid does not need to exceed 5%. Only 3 months' ledger required if the fund source is from Bonus/Commission, Dividends or a Tax Refund.

- ANZ: First Home Buyers & Owner-occupied only. 3 months' Rental Ledger or 3 months account statements clearly identifying the rental payments.

- Suncorp: Gifts/inheritances can be accepted along with a 3 month rental ledger.

For a private rental, ANZ would be the best option. In all cases above, rent should be paid consistently and on-time.

Non-genuine Savings loans

If using a non-repayable gift or inheritance with a deposit less than 10%, ME Bank can accept this.

Liberty Financial does a 5%, non-genuine savings product with flexibility around the source of funds. The rates/fees are higher than a traditional bank and you'll need to be in a strong position from an affordability point of view. But if you can't meet the genuine savings requirements above and need to get a loan ASAP, that would be the best option.

DISCLAIMER: You must not rely on the information in the report as an alternative to financial advice from an appropriately qualified professional. If you have any specific questions about any financial matter you should consult an appropriately qualified professional. We do not represent, warrant, undertake or guarantee that the use of guidance in the report will lead to any particular outcome or result. The content, calculations and opinions contained in this article are of the writer only, and are not necessarily those of Blue Fox Finance. Whilst we take care in ensuring the accuracy of the information, policies are changing regularly and this webpage may not reflect the most recent information.