How much deposit do I need to buy a house?

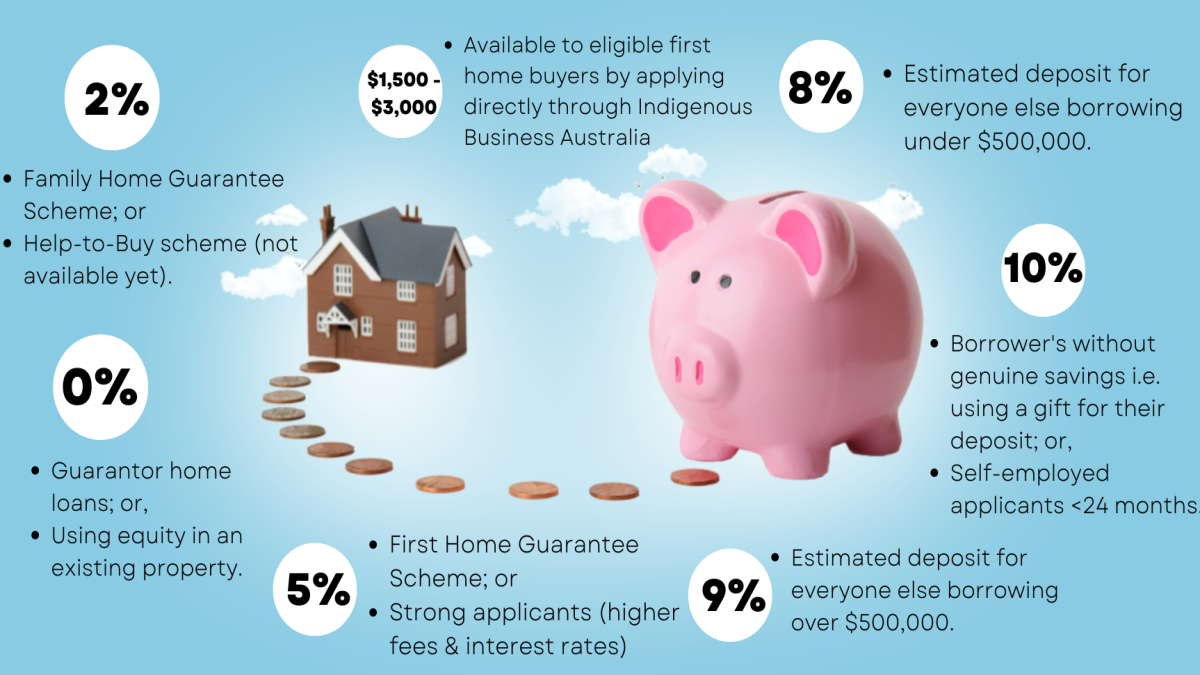

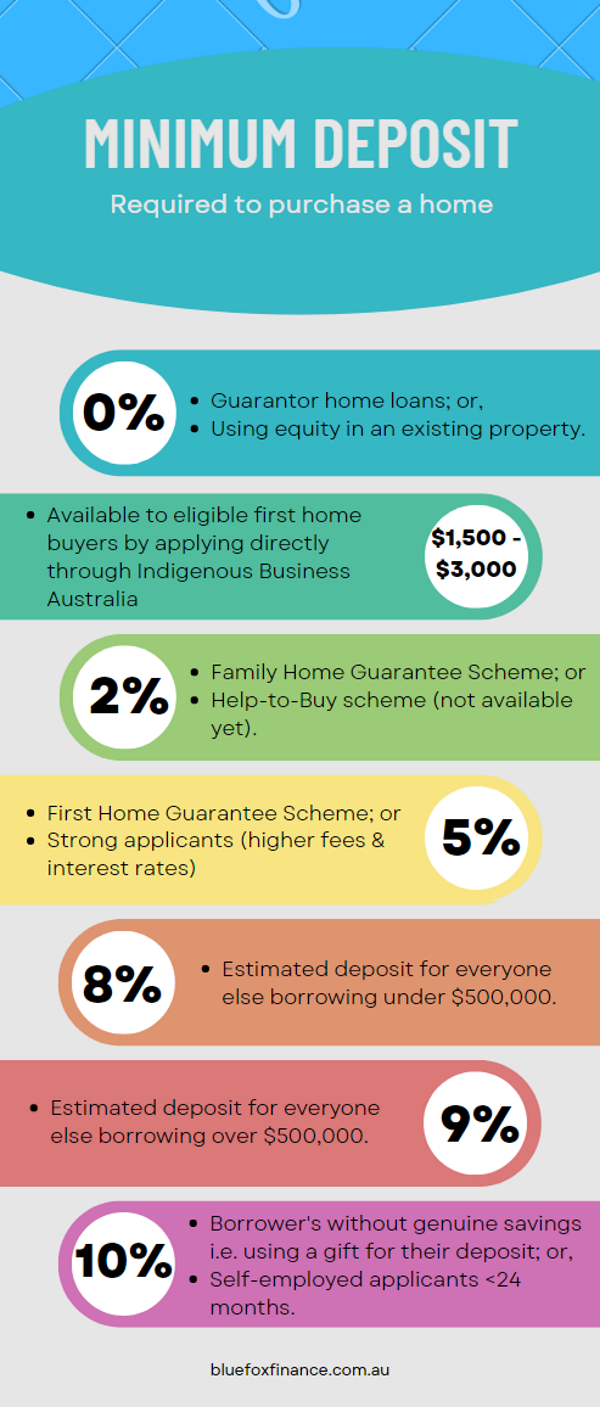

Use this article as a starting point to give you a good idea of how much deposit you'll need to buy a house in Australia - but always seek professional advice. The minimum deposit is 0% with a Guarantor, 2% under the Governments Family Guarantee, 5% under the Governments First Home Guarantee, and 5% - 9% for almost everyone else - I'll explain each one in more detail down the page. To purchase a house, you'll need your deposit (0% - 9%) plus Government charges plus costs (usually about $3,000), please refer to the costs of buying a house for a full breakdown of the other fees associated.

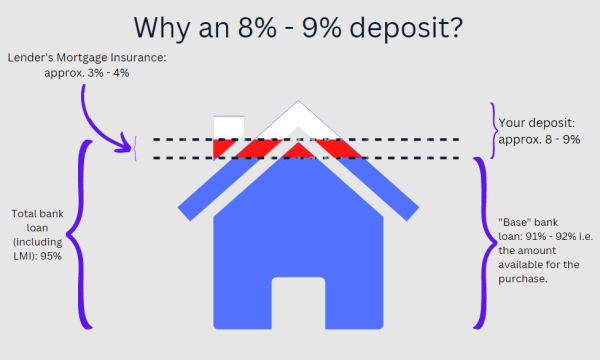

Note: whilst a 5% deposit is available, an 8%-9% deposit is recommended for most applicants that are applying without the aid of a Guarantor or Government Scheme.

As a Mortgage Broker, we can assist you in applying for your home loan. There is no charge for our service as we're paid a commission from the banks. Our services include Guarantor loans, Family Guarantee Loans & First Home Guarantee Loans - including upfront reservation of your spot. You can learn more about our home loan process here.

The Minimum House Deposit

The absolute minimum deposit requirements in QLD range from 0% - 10% depending on your situation.

We can provide you a full breakdown and deposit requirement based on your situation and purchase property type/location.

If you'd like us to check your home loan eligibility and provide you with a home loan options, please submit an enquiry through the contact form.

Enquiry Form

| A 0% home loan is only available to: |

|---|

| Applications which include a Guarantor |

| Applicants with an existing property with equity available. |

| A 2% home loan available through the Government's Family Guarantee may be available to an applicant who: |

|---|

| Is a single parent with at least one dependent child; and, |

| Is an Australian Citizen; and, |

| Is earning under $125,000 per annum; and, |

| Is not currently a property owner; and, |

| Are buying within the Governments price range for that suburb; and, |

| Has sufficient income & credit history. |

We can assist you in applying for any of these types of loans at no cost to you.

| A 5% home loan with no LMI costs is available through the Governments First Home Guarantee to applicants or couples who: |

|---|

| Are first home buyers; and, |

| Are Australian Citizens; and, |

| Earn less than $125k as an individual, or $200k as a couple; and, |

| Are buying a property to live in, and, |

| Are buying within the Governments price range for that suburb, and, |

| Has sufficient income & credit history. |

| A 5% home loan with LMI may be available to applicants who: |

|---|

| Have saved the 5% themselves i.e. has genuine savings; and, |

| Have a strong income-to-expenses position; and, |

| Are first home buyers; and, |

| Have good credit history; and, |

| Are buying a property to live in; and, |

| Are happy to pay higher interest/fees due to the low deposit. |

Please email me at zak@bluefoxfinance.com.au or call on 0466392717 if you have any questions or you'd like assistance applying for any of these types of loans.

Deposit Requirements for everyone else...

If you don't fit into the above categories, you'll likely need between an 8% and 9% deposit - unless you don't meet the major banks' criteria. An 8%-9% deposit is required as a minimum with almost all major and second tier banks, for example: CBA, ANZ, Westpac, NAB, Macquarie, Suncorp, ING, GSB, ME Bank, St George and so on. The reason it's an 8% - 9% deposit is because they won't lend more than 95% of the property value, however this amount must include LMI. LMI is added to the loan amount and usually works out to the below figures (approximate only):

- For properties under $500k: 92% of the property value as a loan + 3% LMI - requiring an 8% deposit.

- For properties over $500k: 91% of the property value as a loan + 4% LMI - requiring a 9% deposit.

| An 8% - 9% deposit home loan is generally available to: |

|---|

| Permanent employees (1 payslip) or casual (6 months minimum) |

| Australian Permanent Residents or citizen. |

| Must have 'genuine savings' aka funds saved/held for 3 months. A rental ledger through a Real Estate Agent is available in some circumstances. |

| Good credit history. |

| Applicants that are self employed need to have been trading for 24 months. |

| Situations where you would need a 10% - 20% deposit: |

|---|

| If you've been self employed for less than 2 years. Refer to self employed home loan requirements for specific details. |

| If you have bad credit: generally more than 1 or 2 defaults will require 15% deposit or more. |

| If you don't have 'genuine savings', you will need a 10% deposit. |

| When buying an unusual property: common examples are high density apartments in Brisbane CBD, or properties over 5 acres. |

| If you don't meet Lenders Mortgage Insurance's criteria, you may require a 20% deposit. |

| If you are not a permanent resident of Australia. |

Why would you want to put in a higher deposit amount?

Using the minimum allowable deposit is a great option for many people to get into the housing market without saving a large deposit; however, if you have more funds available, there are distinct advantages for using a larger home loan depsoit:

- 0% - 5% Deposit: The minimum required to purchase a house. See criteria outlined above.

- 8% - 9% Deposit: If you can't get LMI waived by using a Guarantor or Government Scheme, having an 8%-9% deposit will give you access to a large number of banks and reasonable interest rates.

- 10% Deposit: Having a 10% deposit will open these lenders up to you and could mean you get a better deal. Lender's Mortgage Insurance Premiums are also much less with a 10% home loan deposit. You can also get away without genuine savings with one lender at this LVR and may have an easier time getting approved with most lenders.

- 15% Deposit: With a 15% deposit, you can usually find a $0 or $1 LMI deal with the right bank..

- 20% Deposit: A 20% deposit will get you a very competitive interest rate and a wide choice of lenders. You also will not need to pay a Lender's Mortgage Insurance Premium in most cases, and will be subject to less strict approval criteria in general.

Using the Government's Super Saver Scheme to save your deposit

If you're in the process of savings for a deposit but are 12 months or more away, we would strongly recommend looking into the Government's First Home Super Saver Scheme. It's a free incentive that can give you tax breaks by saving for your first home through additional Superannuation contributions.

Can you use the FHOG $15k as part of your deposit?

As a general rule, yes - but you still need to have saved a 5% deposit yourself. For full details, check out our article: First Home Owners' Grant QLD.

Other information to help you buy a home

If you're a first home buyer, we'd strongly recommend looking at the following schemes, or talking to us about what you may be eligible for:

| Government Schemes available: |

|---|

| Stamp duty concessions: full stamp duty concessions available for first home buyers purchasing for under $500k. |

| First Home Owner's Grant QLD: $15k available for eligible purchases of new properties. |

| First Home Super Saver Scheme: first home buyers can make additional Super contributions then redraw to use for their property purchase. |

| First Home Guarantee: using a 5% deposit, the Government will guarantee your loan to avoid you paying LMI. |

| Family Home Guarantee: for single parents, you can use a 2% deposit & have the Government guarantee the rest of the loan. |

| Help to Buy: The Labor Government's new scheme to allow you to purchase with a 2% deposit by sharing the property ownership with the Government. Expected to be available in 2023. |

TLDR; How much deposit do I need in Australia?

5% if you have a strong application or are eligible for a Government Scheme, otherwise 8% - 9% of the purchase price in most cases. Talk to a Mortgage Broker to check your eligibility etc. We can do all checks and lodge the application on your behalf and don't charge any fees - if you found this information useful we would really appreciate you giving us a call.

We can provide you a full breakdown and deposit requirement based on your situation and purchase property type/location.

If you'd like us to check your home loan eligibility and provide you with a home loan options, please submit an enquiry through the contact form.

Enquiry Form

Minimum Deposit Requirements FAQ

Is 5% enough for a house deposit?

It is if you have a very strong application, or are eligible for the Government's First Home Guarantee or Family Guarantee.

What costs are there other than the deposit when purchasing in Australia?

On top of your deposit, you should budget $3,000 for Solicitors, bank fees etc. + enough to cover the Government fees (calculator here).

How do I apply for a Government Scheme home loan?

A Mortgage Broker (such as ourselves) can assist you in reserving a slot upfront, getting your pre-approval, and then finalising the application once you've found a property.

Do you really need a 20% deposit? Or why do people say you do?

In the majority of cases, you won't need a 20% deposit; however some banks do require a 20% deposit as minimum. Other reasons that some banks will want a 20% deposit: unstable employment, unusual property, restricted postcodes, poor credit history.

Why is an 8% deposit usually recommended?

There are very few lenders that will do a 5% loan if you're not eligible for a Government Scheme - and these lenders have strict criteria, and charge a high interest rate. Most major and second-tier banks will allow you to borrow 95% of the property value, however this must include the Lender's Mortgage Insurance Premium, which is usually around 3%. As a rough estimate, you would then end up borrowing 92% of the property value + 3% LMI, thereby requiring you to input an 8% deposit.

DISCLAIMER: You must not rely on the information in the report as an alternative to financial advice from an appropriately qualified professional. If you have any specific questions about any financial matter you should consult an appropriately qualified professional. We do not represent, warrant, undertake or guarantee that the use of guidance in the report will lead to any particular outcome or result. The content, calculations and opinions contained in this article are of the writer only, and are not necessarily those of Blue Fox Finance.