What Documents do I need for a Home Loan?

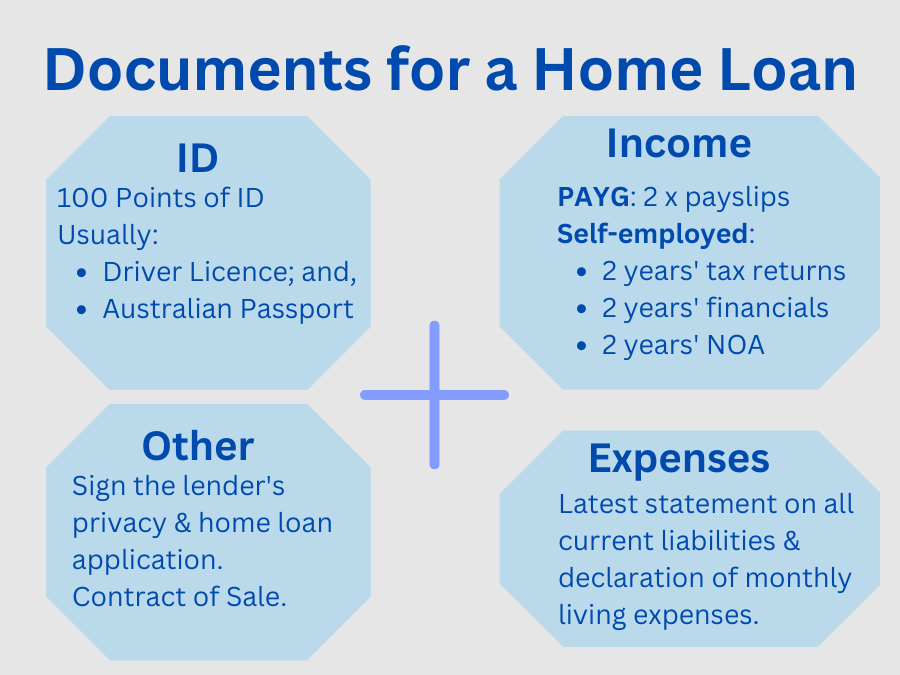

The documents you need for a home loan application will vary from lender-to-lender - so it's generally best to contact your Banker or Broker to get an exact list of what you'll need. Nevertheless, the requirements between banks are usually fairly similar. We'll go into each category more in-depth down the page, but an overview of what you'll need:

| Simplified list of documents required for a home loan: |

|---|

| 1: Identification: Driver Licence and/or Passport is usually sufficient. |

| 2: Lender Privacy & application: The lender will need you to sign their applicaiton forms. In some cases, this is just their privacy notice. |

| 3: Income Documents: For most people, this is just your 2 most recent payslips. |

| 4: Expense Documents: You'll generally need to provide proof of your current loan repayments and Credit Card limits. |

| 5: Contract of Sale: Unless you're applying for a pre-approval or refinance, the bank will need the full executed Contract of Sale. |

1: Identification Documents needed for a home loan

Some lenders will let you get away with one form of photo ID, usually a Driver Licence or Passport. You'll also need to have this verified; you can usually do this with an in-person meeting with your Broker, video call, or by providing JP Certified copies.

Many lenders will look for additional ID documents. Generally they'll be aiming for the '100 points of ID'. As a general rule, you'll need either two primary photo IDs or one primary photo ID + 2 secondary IDs. As a general overview, you may be able to use the following:

| Primary photo ID acceptable for a home loan: |

|---|

| Driver licence (not expired) |

| Australian Passport (expired within the last 2 years) |

| Overseas Passport (plus proof of Permanent Residency). |

| Proof of Age Card. |

| Common secondary ID requirements: |

|---|

| Citizenship Certificate |

| If name has changed: Marriage Certificate or Change of Name Certificate. |

| Medicare Card. |

2: Lender Privacy & Application

Each lender has different requirements for these documents. All lenders will require your signature on at least one document: they may accept a digital signature or may require a wet signature. In all cases, you'll need to sign a Privacy Consent of some sort. They will often have additional documents included in their home loan application pack for your signature. Your Mortgage Broker should prepare these for you.

3: Income documents required for a home loan

Most commonly, for a permanent PAYG employee, you'll just need to provide your 2 latest payslips. You'll have to provide other documents if you're relying on other income such as rental income, bonuses, commission, overtime, ABN income, Centrelink etc. Here's a guide around what you'll usually need to provide to evidence each income source:

| Documents required to evidence each income source: |

|---|

| PAYG Permanent: 2 latest payslips. |

| PAYG Casual: 2 latest payslips + latest PAYG Summary or 6 months' bank statements. |

| Commission: 2 latest payslips + latest PAYG Summary. |

| Bonuses: Last 2 years' tax returns. |

| Rental Income: Latest rental statement or tax return. |

| Centrelink: Latest Centrelink statement. |

| Dividends/investments: Last 2 years' tax returns. |

| Self-employed full doc: Latest 2 years' financials: ITRs, NOAs, CTRs, P&Ls, Balance sheets etc. |

| Self-employed low doc: Latest 2 BAS, Accountant's Letter or 6 months' bank statements. |

4: Expense documents required for a home loan

Sometimes, you can get away without providing expense documents if your current loans are showing on your Equifax Credit Report. Most of the time, you'll need to provide evidence of your current liabilities. This includes your latest statement for any: credit cards, buy-now-pay-later, personal loans, car loans, mortgages, ATO debts, overdrafts, child support etc.

5: Contract of Sale

If your home loan application is for the purchase of a property, the bank will always need to see the signed and dated Contract of Sale. They will usually complete a valuation based off the details provided in the contract (but not always). If you're instead refinancing, you'll need to provide your latest Council Rates Notice. If you're only applying for a pre-approval, you won't need to provide this for the initial submission, but you'll still need to send in the Contract of Sale once you've found a property and are ready to get your formal approval.

How to get your home loan process started

If you have any questions or would like to get the process started, please contact us via the footer form or our contact us. We're an established Mortgage Brokerage with excellent customer reviews. If you need a second opinion on anything, don't hesitate to ask.

FAQ about the home loan document requirements:

What ID will I need for a home loan?

It varies from lender to lender. Some lenders will ask for just a Driver licence or passport. Other lenders will ask for a full 100 points of ID. You may also need to provide a change-of-name or marriage certificate if you've recently changed your name.

What income documents will I need for a home loan?

For full-time PAYG, you can usually just provide your latest 2 payslips. For casual, you'll sometimes also need your last year's PAYG Summary. Self-employed applicants will usually need to provide a full 2 years' financials: personal tax returns, Notice of Assessments, company tax returns, company profit & loss + balance sheet.